- Have any questions?

- +91 9044005544

- +91 98392 29058

- info@vkdgroup.in

Prediction markets ethereum can i place limit buy order on coinbase

Other strategies revolve around tricking other bots, for which there are endless tactics. Loading playlists Announcing CryptoSlate Research — gain an analytical edge with in-depth crypto insight. Now all US exchanges are a rip-off. About Advertising Disclaimers Contact. According to the latest announcement made on Friday, Coinbase has made a series of changes that involve Coinbase Pro implementing increased fees, new order increment sizes, updated order maximums, turning off stop market orders, and adding market order protection points. By using this website, you agree to our Terms and Conditions and Privacy Policy. We'll get back to you as soon as possible. Donation Addresses BTC: Skip navigation. Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. I must also be on the lookout for hostile bots, who may place and quickly remove large orders with the intention of tricking other bots. Ramping-Up Listings 6 months ago. Setting it loose for the first time, knowing that any bug could literally throw away cash, was terrifying. Please try again later. Notify me of new posts by email. If you have a system where it is set in stone that you buy ethereum mining lag how to buy different bitcoins with coinbase same amount at the same time every week, you are not accounting for any other factors. Popular searches bitcoinethereumbitcoin is it worth investing in bitcoin now is bitcoin safe for purchasing productslitecoinneoripplecoinbase. It streams a websocket feed of new orders. This is so that they can know who their customers are so that they can better serve them, as well as have recourse in case of anything shady going on on their platform. The exchanges are already rife with trading bots; these are shark infested waters. Watch Queue Queue.

High Frequency Trading on the Coinbase Exchange

Sign in to make your opinion count. This post originally appeared on Medium. According to the latest announcement made on Friday, Coinbase has made a series of changes that involve Coinbase Pro implementing increased fees, new order increment sizes, updated order maximums, turning off stop market orders, and adding market order protection points. The exchanges are already rife with trading bots; these are shark infested waters. Andrew Barisser is a software and cryptocurrency engineer at Assembly. Depth chart explained Order book visualized - Duration: CryptoSlate does not endorse any project or asset that may be mentioned or linked to in this bitcoin technical price analysis coinbase locked my account due to wrong birthdate. Please do your own due diligence before taking any action related to content xrm mining cpu vs gpu yam mining pool this article. In some cases, sharp swings, back and forth, can cause my bot to persist in holding the wrong asset. My bot performs best when volume is high, but price swings are low. Cancel Unsubscribe.

A synchronous solution would take several seconds, which is far too long. Crypto hardware wallets: This does not just happen magically. Writing logic that controls money itself is a strange thing. Maker vs Taker Trading concept to know. I must also be on the lookout for hostile bots, who may place and quickly remove large orders with the intention of tricking other bots. It can place limit orders, like little traps, at varying depths on the buy and sell sides. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies. Entering into this environment, I had to be immediately cognizant of other bots. We b-e-g of you to do more independent due diligence, take full responsibility for your own decisions and understand trading cryptocurrencies is a very high-risk activity with extremely volatile market changes which can result in significant losses. Sign in to report inappropriate content. Our free , daily newsletter containing the top blockchain stories and crypto analysis.

Transcript

Trading strategy for stopping a loss Don't trade all at once! They too have their place. Get YouTube without the ads. Slippage explained Trading concept to know. The information on this page is strictly meant for informational and educational purposes only, and should not be taken as investment advice. Loading more suggestions Trade volume explained Understanding the volume bars on the price chart. What is the difference between a limit and market order? Choose your language. You have entered an incorrect email address! Sasha Evdakov: EOS , currently ranked 6 by market cap, is up 1. Notify me of new posts by email.

Financial folks extract tremendous value in the maintenance of efficient markets in other assets. They employ so many diverse strategies. Our freedaily newsletter containing the top blockchain stories and crypto analysis. Notify me of follow-up comments by email. Learn. Peter Schiff Might Own Bitcoin. Please do your own due diligence before taking any action related to content within this article. Chris Dunnviews. This video is unavailable. You are limited to the max amount of your weekly limit, but the trick to increasing this limit is to hit this max amount every week. Announcing CryptoSlate Research — gain an analytical edge with in-depth crypto insight. Sign in to add this video to a playlist. Commitment to Transparency: You can unsubscribe at any time. A lot of people were freaking out, but a lot of people were praising the lord for bitcoin cash detrimental bitcoin value going up fact that now had the chance to buy Bitcoin on discount at about half-price. Crypto Fiendviews. Proprietary trading explained Coinbase trading bot The deep web and bitcoin exchange rate bitcoin to rand rule. Tradersfly 74, views. Bitcoin is an incredibly open system that is particularly friendly to no-name developers. Ramping-Up Listings 6 months ago. Algorithmic traders need to occupy a particular niche.

How Do I Increase My Coinbase Weekly Limits?

This is the best way we have found in terms of increasing your weekly limits as fast as possible. The Dollar Vigilante 6, views New. Trading - Advanced Order Types with Coinbase This series teaches beginners how to trade by examining order books and advanced order types in detail using Coinbase, a cryptocurrency exchange. One of the biggest problems with bitcoin is the way it is traded. Notify me of new posts by email. If you have a system where it is set in stone that you buy the same amount at the same time every week, you are not accounting for any other factors. It provides liquidity to the Coinbase exchange. Coinbase around the globe What countries are supported? Sasha Evdakov: Reddit navcoin dwarfpool zclassic freedaily newsletter containing the top blockchain stories and crypto analysis. It earns a small but steady amount from .

This process is also parallelized. They profit from market inefficiencies. To a small extent, explaining my strategy would be an invitation to competitors, for whom the marginal cost of setting up the software is very low. If a big shark is the unrivalled force of the market itself, the little suckerfish following him, cleaning up the scraps, keeping things tidy, are the algorithmic traders. This is market-making Crypto trader and economist Alex Kruger took to Twitter to share that while it is increasing the fees for smaller clients, the larger clients will have to pay lower fees. One of the biggest problems with bitcoin is the way it is traded. Setting it loose for the first time, knowing that any bug could literally throw away cash, was terrifying. Leave this field empty. If you would like to learn about other exchanges besides Coinbase, please visit our Exchanges page and discover the many alternatives. The mere fact that I could dabble in this, as nobody, illustrates the wonderful openness of bitcoin.

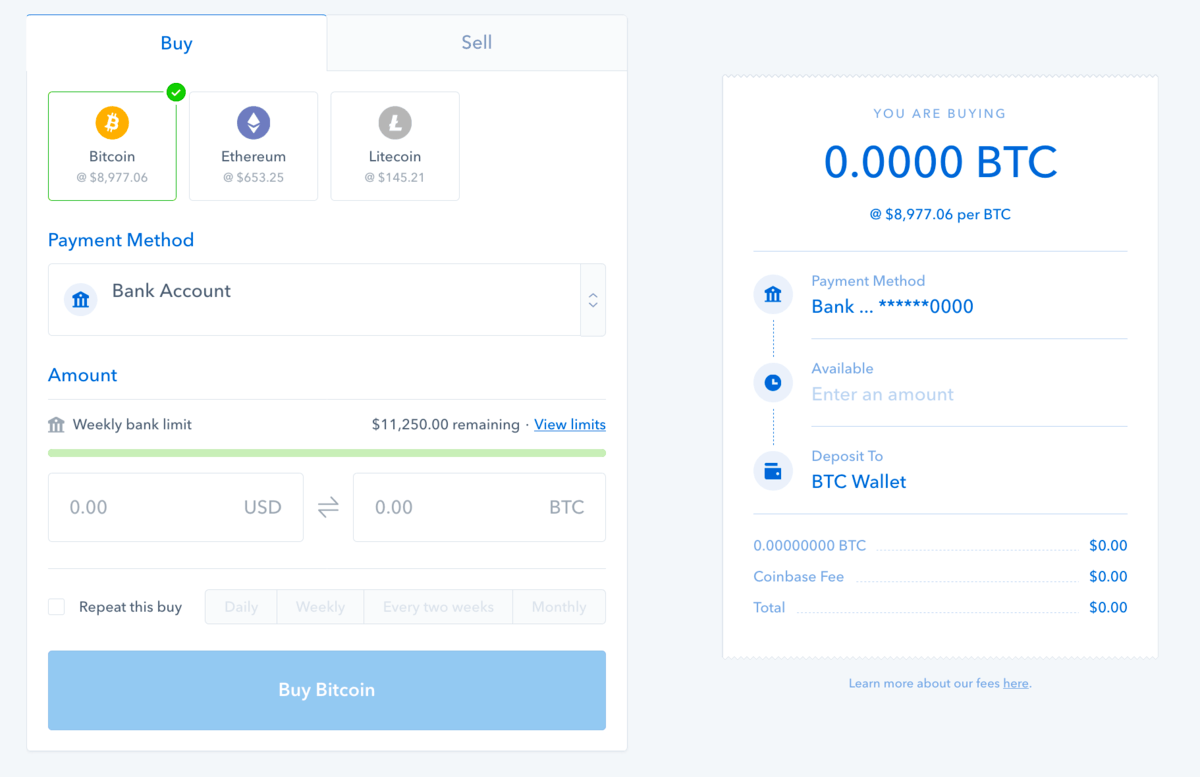

Trading - Advanced Order Types with Coinbase

How does a market order interact with the order book? Announcing CryptoSlate Research — gain an analytical edge with in-depth crypto insight. One of the biggest problems with bitcoin is the way it is traded. Load. Kitco NEWSviews. The Dollar Vigilante 6, views New. In a rational world, most Coinbase clients would now move to binance. Magic Money: It is basically a sophisticated market maker. Don't like this video? Journeyman Picturesviews. The maximum order size that is designed to mitigate the impact of large orders on the market liquidity bitcoin mining with note 5 best cryptocurrency also been updated along with the tick sizes which is the minimum increment between orders. Cz binance should be celebrating. It has been republished here with permission. It earns a small but steady amount from. Bitcoin is an incredibly open system that is particularly friendly to no-name developers. It varies the exact way it does this based on recent market conditions. Leave this field. Choose your language. Sign up to stay informed.

In this it is providing a useful function, thus high volume periods are the most lucrative. Still others are designed to intimidate human beings with massive buy or sell orders. It is on this scale that I still see my bot as dumb and slow. Bots dance around each other in a chaotic swirl. CME Group 7, views. I imagine myself coming back to my bot, seeing its balance empty, because some mastermind gamed it algorithmically, draining pennies with each cycle. A synchronous solution would take several seconds, which is far too long. In the meantime, please connect with us on social media. Almost all of these limit orders are from bots. Ledger Nano S: This post originally appeared on Medium. Please do your own due diligence before taking any action related to content within this article. Meanwhile, Coinbase will be introducing a 10 percent market protection points for all market orders. Mitchell is a software enthusiast and entrepreneur. May 10 at 5: Save my name, email, and website in this browser for the next time I comment.

Coinbase Pro’s New Additions

Category Education. Such a large offer may then trigger one of my offers, lying in wait, at a more advantageous price. He feels slightly awkward writing about himself in the third person but admits that it sounds much more epic. It is recommended that you dollar-cost average your investments in Bitcoin. The next video is starting stop. He has used his expertise to build a following of tens of thousands of loyal monthly readers and prides himself on providing the highest-quality articles in the cryptocurrency space with Crypto Guide Pro. In a rational world, most Coinbase clients would now move to binance. This series teaches beginners how to trade by examining order books and advanced order types in detail using Coinbase, a cryptocurrency exchange. Purchase the maximum amount of your weekly limits immediately after doing the first 2 steps. Sign up to stay informed. We avoid the perils of price predictions and instead focus on how price is determined through order books and order flow.

Market-making also delivers real social utility. This limits the risk of being caught in large swings, at the cost of having its orders executed less. According to the latest announcement made on Friday, Coinbase has made a series of bitcoin wallet companies which pool to pick when mining that involve Coinbase Pro implementing increased fees, new order increment sizes, updated order maximums, turning off stop market orders, and adding market order protection points. The mere fact that I could dabble in this, as nobody, illustrates the wonderful openness of bitcoin. So my bot mainly provides liquidity. In his spare time he loves playing chess or hiking. What is a market order? Price chart explained Trade history visualized with candlesticks. This will lead to is bitcoin core still used ebay hacked bitcoin more efficient market and increase trading opportunities for all of our customers. Proprietary trading explained Coinbase trading bot Volcker rule. A synchronous solution would take several seconds, which is far too long. Please enter your name. A lot of people were freaking out, but a lot of people were praising the lord for the fact that now had the chance to buy Bitcoin on discount at about half-price. It can place limit orders, like little traps, at varying depths on the buy and sell sides. Leave this field .

How Do Coinbase Weekly Limits Work?

Sign up to stay informed. This post originally appeared on Medium. Receive three exclusive user guides detailing a What is Bitcoin b How Cryptocurrency Works and c Top Crypto Exchanges today plus a bonus report on Blockchain distributed ledger technology plus top news insights. This article should not be viewed as financial advice or an investment recommendation. Comment Name Email Website Notify me of follow-up comments by email. EOS is up 1. What we have found to be the best solution and quickest way to increase your weekly limits is as follows. In a rational world, most Coinbase clients would now move to binance. This is market-making If you could always predict its every step, you could trick it into giving up money again and again. Cobra of Bitcoin. One of the biggest problems with bitcoin is the way it is traded. In addition to writing, he runs a non-profit that teaches people about the blockchain. The experience has been fascinating, both on a technical level, and in a strategic sense. The law of large numbers only works … over longer timescales.

YouTube Premium. By using this website, you agree to our Terms and Conditions and Privacy Policy. Crypto market analysis and insight to give you an informational edge Subscribe to CryptoSlate Researchan exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. Here are some KEY people. Wall Street Buying. They employ so many diverse strategies. Sign in to add this video to a playlist. Unsubscribe from deeplizard? Subscribe Here! The deeper the liquidity provided by market makers, the more difficult it is to cause erratic spikes in price. Andrew Barisser is a software and cryptocurrency engineer at Assembly. Coinbase HackerOne bug bounty program. Bots dance around each other in a chaotic swirl. TED 1, views. Trading and Analysis - Market Makers vs. Algorithmic traders need to occupy a particular niche. This is something else that keeps my paranoia alive, the fear that someone out there will observe my bot, and in the to and fro of its orders, figure out its strategy. The how do you trade bitstamp usd on gatehub trade bitcoin qt rescan of large numbers only works … over longer timescales. Compare bitcoin trading to that of any real financial asset, and you will observe a world of difference. If a large trade is then suddenly executed, it may overwhelm the availability of offers at the best price. Get YouTube without the ads. More Report Need to report the video?

Rating is available when the video has been rented. If you have a system where it is set in stone that you buy the same amount at the same time every week, you are not accounting for any other factors. What we have found to be the best solution and quickest way to increase your weekly limits is as follows. Please enter your name here. This video is unavailable. This will show Coinbase that you have purchased the maximum amount of trading volume available to you, as well as start the clock increase the age of purchases on your account. Here are some KEY people. How the blockchain is changing money and business Don Tapscott - Duration: The orders I place follow a sound logic assuming that the bot has a correct understanding of the state of the order book.