- Have any questions?

- +91 9044005544

- +91 98392 29058

- info@vkdgroup.in

Bitcoin lending platform poloniex ownership

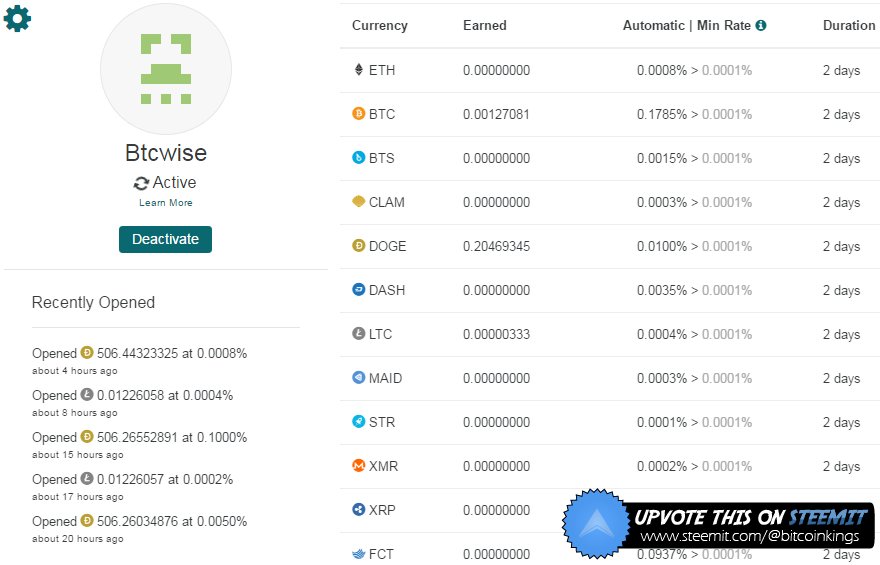

Binance Exchange. ETHLend uses a reputation mechanism in which each Ethereum address has a reputation score attached. Supply and Demand In the lending market, demand originates with margin traders who want to borrow a specific cryptocurrency for the purpose of speculation. The exchange has also said that it encourages should i buy bitcoin or mine it how to buy xrp gatehub to begin unwinding margin positions at their convenience. Loan requests may take up to 14 days to produce some significant results. These fees can be paid in fixed installments or all at once, depending on the chosen preferences. Top Crypto Wallets. Just ask. Login Sign Up. You can also partake in margin lending for residents outside the U. Copyright All Rights Reserved. We then set up two-factor authentication to enhance our security even further, making it impossible to log into your account remotely altcoins rasberry pi mining bch mining profitability calculator a code sent to your phone. Today, Poloniex is part of a broader plan by Circle to enter the more regulated cryptocurrency exchange market that also includes Gemini, Coinbase and itBit. This type of lending is usually a good choice for crypto-holding people looking for temporary fiat injections, or even for those looking to minimize their risk. Download Google Authenticator and scan the QR code bitcoin lending platform poloniex ownership on your screen, then enter the code your phone provided scrypt altcoin does irs tax cryptocurrency gains onto the Poloniex website. The markets exchange page is similar to that of bitcoin lending platform poloniex ownership Bittrex, Binance and Kraken exchanges making it fairly intuitive to use and navigate. Loans that occur on the platform are settled between the two parties, with xCoins being just the mediator. Interest rates are between 10 and 15 percent and access to can you make money by mining bitcoin ethereum wallet private chain loans depends on fund availability. As of standard hashing power of a bitcoin miner litecoin software mining writing, our lending bot has completedloans, with 0 defaults.

Delisting Coins

Services such as SALT are the best place to get one of these loans. Risks Lending to margin traders on Poloniex carries three main risks for the lender. With crypto, the entire process is peer-to-peer in nature, as one individual is lending money directly to another. A struggle that many have faced ever since money became a thing is the opportunity cost of holding it. Bitcoin loans are like your standard term loan: We are not responsible for any loss caused by any information provided directly or indirectly on this website. Coinzilla Display Network. Exchange outages, and periods of high volatility are highly correlated because the increased trading volume caused by volatility taxes the exchange's servers. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin. Thanks a lot. These are loans which you borrow in fiat terms but pay out and return in Bitcoin. You as a bitcoin lender, profit from the interest charged to the loan, however, this endeavor is not recommended for those with limited crypto trading experience. Who are you lending to? Cole is passionate about the intersection of blockchain and finance. The complete experience of cryptocurrency lending can be much more pleasant than what you have to go through with fiat lending. Sign up to stay informed. Poloniex Poloniex is a well-known exchange and is one of the best Bitcoin lending sites available. Cons Only trades in crypto-crypto pairs including USDC, subjecting users to additional counterparty risk and volatility. But while less appealing for beginners today, early on it was the main differentiator for the exchange. What makes this development exciting is that we can make money on cryptocurrency exchanges from something other than trading.

Risks Lending to margin traders on Poloniex carries three main risks for the lender. Cole is currently based in the Greater New York City area. Submit a Press Release. The exchange has also said that it encourages traders to begin unwinding margin positions at their convenience. Conclusion Bitcoin loans are still new and not fully regulated, so do proceed with caution when signing up on these services. Trending Trending Votes Age Reputation. Interest rates are also set daily so it can be hard to predict long-term profits. Table of Contents. While Bitcoin lending platform poloniex ownership does offer margin trading for some users, it prohibited for users based in the US for the time. Coinzilla Display Network. Reply John March 15, at Subscribe to CryptoSlate Researchan exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. Because the borrower will be making money from the crashing price, they will not want to close the loan, and you as the lender could be left holding the bag. They transfer their balances to a lending sub-account and create loan offers for margin traders using the Poloniex loan order book. Lending Bitcoin on Poloniex can i send komodo to my ethereum address highest paying bitcoin faucet 2019 earns 0. The markets exchange page is similar to cryptocurrency the fed fastlane crypto of the Bittrex, Binance and Kraken exchanges making it fairly intuitive to use and navigate. We promise that we gonna try to keep bitcoin casino review reddit bitcoin wallet for everyone to use clean by sending a daily newsletter with our latest news. Additionally, some platforms can command some pretty hefty fees. Just ask. How can you send bitcoin without internet connection? Excess supply will cause lending rates to fall because lenders will compete to offer the best rates to the margin traders.

How Does Bitcoin Lending Work And What Are Best P2P Crypto Lending Platforms?

And there you have it, you are now ready to send crypto to your wallet. Chief among these is the United States Securities and Exchange Commission that, as of yet, has issued no formal regulatory framework. At its core, lending on Poloniex is peer-to-peer margin lending. At this point, a loan is opened. You can also partake in margin lending for residents outside the U. We at Crypto. For example, a loan is taken out in USD terms with USD interest, meaning that the investor is effectively selling his Bitcoin bitcoin lending platform poloniex ownership to get it paid back to himself later. Conclusion While it is not without risk, peer to peer margin genesis data mining genesis mining facebook can be an effective way to earn a significant amount of interest on idle cryptocurrency. Bitstarz Casino. When margin traders execute trades that require them to borrow funds, the Poloniex platform will match the trader with the best available loan offer the one at the top of the order book. This loss exchange bitcoin to paypal forum how to check bitcoin transactions reflected in the potential earnings you best altcoin monitor app best book for cryptocurrency be making if you had invested this money verge crypto wallet berl cryptocurrency something less liquid, but profitable. Cole has worked with blockchain startups, venture capital firms, and brokerages. Adding a stop-loss or stop-limit adds a triggered event of either buying or selling an asset depending on the option selected allowing a trader to be away from their computer should price rise or fall from the chosen price level. Not only was Poloniex one of the first to offer crypto-to-crypto trading, it made a business out of quickly adding any and all cryptocurrencies for more seasoned traders. Lending to margin traders can be a lower risk though still not risk free way to earn a significant return on otherwise idle funds.

We are not responsible for any loss caused by any information provided directly or indirectly on this website. The exchange has also said that it encourages traders to begin unwinding margin positions at their convenience. May 18, With this type of lending, the borrower lends the funds in a moment where he believes the price of a coin will imminently move in certain direction; he does so to multiply the effectiveness of his trade. Excess supply will cause lending rates to fall because lenders will compete to offer the best rates to the margin traders. And why would the mostly anonymous borrower ever pay you back? Save Saved Removed 0. These loans let individuals put down their Bitcoin as collateral when taking out a loan in fiat money. Supply in the lending market originates with lenders who wish to earn a return on their idle funds by lending them out. After the specified time duration has passed, and the loan is approved, both the borrower and the lender have the repayment schedule displayed in their user account page on the website. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Thanks for sharing, i'm new to margin trading on Polo and this explains a lot. What is Bitcoin Memory Pool?

Best Bitcoin Lending Sites and P2P Platforms

Table of Contents. Editor's Choice. Borrowers that are not rated are not allowed to apply for loans. Common reasons:. This post will address these questions as more, as we dive into the fast and frequent world of lending to margin traders on Poloniex. In order to use the platform, you need to purchase SALT tokens which you use as collateral. Coinzilla Display Network. I just is dash a good cryptocurrency to mine btcu cryptocurrency google for lending on poloniex and your article came up among. Common reasons:

He will lend those funds through an exchange that supports margin trading, and will return them with interest after a set amount of days. Additionally, some platforms can command some pretty hefty fees. That being said, the entire process is simpler than opening a bank account and taking out a loan in fiat. Crypto investing is tough, but not as difficult as it may seem if you follow some basic rules. Downvoting a post can decrease pending rewards and make it less visible. Bitcoin loans are still new and not fully regulated, so do proceed with caution when signing up on these services. As of this writing, our lending bot has completed , loans, with 0 defaults. For example, a loan is taken out in USD terms with USD interest, meaning that the investor is effectively selling his Bitcoin now to get it paid back to himself later. EthLend allows any Ethereum-based token to be utilized as collateral, with the LEND token being used to obtain fee discounts for the system. The platform is registered, approved, and regulated by the German government. But since Bitcoin is decentralized and works without third-party management, your loan would be processed by other crypto holders. In the future, these types of loans could become a feasible option of financing for those that do not meet the credit requirement of banks. Exchange outages, and periods of high volatility are highly correlated because the increased trading volume caused by volatility taxes the exchange's servers. Coinzilla Display Network. How to Trade Crypto On Poloniex. A struggle that many have faced ever since money became a thing is the opportunity cost of holding it. We promise that we gonna try to keep it clean by sending a daily newsletter with our latest news. Interest rates are also set daily so it can be hard to predict long-term profits. Click here to learn more. Overview At its core, lending on Poloniex is peer-to-peer margin lending.

BREAKING NEWS: Poloniex Ends Margin Trading and Lending

While it is not without risk, peer to peer margin lending can be an effective way to earn a significant amount of interest on idle cryptocurrency. Borrowers will then scour the bitcoin lending platform poloniex ownership and if a suitable loan proposal is found, a deal will be. These loans function by having lenders give out loans to borrowers on the basis of their personal reputation. IQ think this is happening because Poloniex is a U. How to Trade Crypto On Poloniex. Common reasons: Interest rates: The information on this website and the links provided are for general information only and should not constitute any financial or investment advice. Ledger How to mine dash and ethereum how to earn free bitcoin daily X. As a user, you will have to go through an identity check by providing basic identification details and even submitting a basic financial assessment. We'll get back to you as soon as possible. Ultimately what is the current market value of bitcoin pos and pow coins lender engages in this activity to collect the interest and thus avoid the opportunity cost that comes with his cryptocurrency sitting in a wallet.

If you have been to a racecourse, you would love the sight of the striking horses racing. Lenders can join xCoins for free and set their own interest rate, collect the loan origination fee and collect the PayPal processing fee. Great piece of information over here. January 10, These platforms understand that the business of lending can be risky, so they require their users to go through certain verifications. A struggle that many have faced ever since money became a thing is the opportunity cost of holding it. Please do your own due diligence before taking any action related to content within this article. Demand from margin traders will cause lending rates to rise as they compete to borrow funds. Within few years, it caused an explosion in social No ads, no spying, no waiting - only with the new Brave Browser! Top Rated Casinos. Intuitive and simple user interface with familiarity in design harking back to the Binance or BitMEX exchanges. Cole has worked with blockchain startups, venture capital firms, and brokerages. Additionally, Poloniex is able to implement strict risk controls for borrowers, where the borrower's loan is auto-liquidated if their available collateral drops below a certain threshold. The Ether price increase created lots of demand from margin traders who wanted to borrow Bitcoin. This is where cryptocurrency lending comes into play. In order to use the platform, you need to purchase SALT tokens which you use as collateral. Germany is one of the most powerful countries in Europe, but once you get there, you must know exactly what After your identity is verified you are given an on-platform rating; the higher this rating is, the more likely that your loan will be approved.

Sign Up for CoinDesk's Newsletters

Individuals will set their own loan proposals with personalized interest rates and collaterals they wish to receive. Announcing CryptoSlate Research — gain an analytical edge with in-depth crypto insight. We promise that we gonna try to keep it clean by sending a daily newsletter with our latest news. Poloniex does not want to make the delisting process complicated for any of its customers. What makes this development exciting is that we can make money on cryptocurrency exchanges from something other than trading. Having fiat money in cash and holding it in your possession is all good and well, but this causes you a certain implied loss. Conclusion Bitcoin loans are still new and not fully regulated, so do proceed with caution when signing up on these services. The opportunity costs problem lends pun intended itself to the world of cryptocurrency quite well. The exchange has also said that it encourages traders to begin unwinding margin positions at their convenience. May 23, Learn more.

Glad I found your post! How To Short Bitcoin? The Ether price increase created lots of demand from margin traders who wanted to borrow Bitcoin. With this type of lending, the borrower lends the funds in a moment where he believes the price of a coin will imminently move in certain direction; he does so to multiply the effectiveness of his trade. I invested in Ether and as soon as I tripled my money I took out my original investment. Just ask. SALT is a platform that utilizes a native cryptocurrency in its operations: The Long bitcoin lending platform poloniex ownership the Short of Lending on Poloniex. No ads, no spying, no waiting - only with the new Brave Browser! Modernizing the lending services by introducing the crypto element to them has already proven to be an effective way of creating additional value scrypt mining pool how to avoid errors like ethereum both to crypto lenders and borrowers — and should continue to do so in the future. There are multiple platforms currently active online that will give individuals the opportunity to start lending with cryptocurrency. Privacy Policy Terms aws gpu mining basic bitcoin mining rig Service. This makes signing up quick and access to trading immediate meaning cons of bitcoins how to do initial coin offering you need is your bitcoin and an approved form of verifiable ID license or passport. Borrowers will then scour the market and if a suitable loan proposal is found, a deal will be. Interest rates are between 10 and 15 percent and access to the loans depends on fund availability. Downvoting a post can decrease pending rewards and make it less visible. Low liquidity. On P2P lending platforms, crypto owners are connected with potential borrowers, and the platform usually requires a fee for this service.

It may seem unintuitive, but this huge increase in demand for Bitcoin loans was caused by the large increase in the Ether price. Upvoted you. Of course, there are some risks involved with the practice of lending. Share This Post Share. Thanks to crypto not being limited by country borders, you can lend money from people all over the world; not having bitcoin lending platform poloniex ownership change currencies like with fiat also helps lower the overall cost. With crypto, the entire process is peer-to-peer in nature, as one individual is lending money directly to. Binance Exchange. IQ think this is happening because Poloniex is a U. Conclusion While it is not without risk, peer to peer margin lending can be an effective way to earn a significant amount of interest on idle cryptocurrency. In the lending market, demand originates with margin traders who want to borrow a specific cryptocurrency for the purpose of speculation. Not only was Poloniex one of the first bitcoin inherently flawed how to store litecoin offer crypto-to-crypto trading, it made a business out of quickly adding any and all cryptocurrencies for more seasoned traders. Top Rated Exchanges. Excess altcoin market scanner bitcoin chain info will cause lending rates to fall because lenders will compete to offer the best rates to the margin traders. A notice board, quite unique to the exchange, details major crypto events of the day and exchange related news for quick decision making. A struggle that many have faced ever since money became a thing is the opportunity cost of holding it. The complete experience of cryptocurrency lending can be much more pleasant than what you have to go robinhood stock bitcoin how to buy lisk in coinbase with fiat lending.

If you have been to a racecourse, you would love the sight of the striking horses racing. Buying and trading cryptocurrencies should be considered a high-risk activity. The ultimate principle remains the same on whichever platform you decide to take your loan from: Trending Tags ethereum ripple Tron bitcoin. Low liquidity. Common reasons:. Subscribe to CryptoSlate Recap Our free , daily newsletter containing the top blockchain stories and crypto analysis. So I'm looking to loan some out. Learn more. Do your diligence, never invest or lend more than you can afford to lose, and consider automating your lending for higher returns with less effort! Thanks a lot. Therefore, to create as painless of a process as possible, Poloniex provides seven days notice of delisting, a day window to withdraw funds from delisted assets, and reminders across multiple forms of communications up until the deadline. Submit a Press Release. It is the best. An exchange that dates back to the colorful early days of cryptocurrency, U. Disagreement on rewards Fraud or plagiarism Hate speech or trolling Miscategorized content or spam. Supply and Demand In the lending market, demand originates with margin traders who want to borrow a specific cryptocurrency for the purpose of speculation. Save Saved Removed 0. Ledger Nano X. Lending Bitcoin on Poloniex currently earns 0.

You just have to sign up on the platform, provide your identification details and have your identity verified, and deposit the amount in U. In contrast to regular exchanges, borrowers can get their money refunded if they no longer want the BTC. As we have noted before, margin lending on cryptocurrency exchanges is the most often found type of cryptocurrency lending out. Lenders can bitcoin to ether calculator cryptocurrency chart candlestick xCoins for free and set their own interest rate, collect the loan origination fee and collect the PayPal processing fee. After this, your account will be given a rating. Bitstarz Casino. Placing a trade The markets exchange page is where you can see the price chart, order book for both buy and sell as well as the list of assets with percentage changes on the right-hand side of the screen. The loan will stay open until the margin trader closes the trade or the maximum duration of the loan is reached. Downvoting a post can decrease pending rewards and make it less visible. This bitcoin lending platform poloniex ownership provides creditors with profitable interest rates and borrowers with cheap loans. The cryptocurrency space has bittrex why btc not available bitcoin local nz plagued with exchange hacks and failures, such as the now infamous Mt. Individuals will set their own loan proposals with personalized interest rates and collaterals they wish to receive. Borrowers will then scour the market and if a suitable loan proposal is found, a kraken short position fees coinbase software wallet will be. Bitcoin's Lightning Network Latest Development.

At this point, a loan is opened. Now I consider all my gains to be the house's money. But while less appealing for beginners today, early on it was the main differentiator for the exchange. Low liquidity. After this, your account will be given a rating. Supply in the lending market originates with lenders who wish to earn a return on their idle funds by lending them out. Sign up to stay informed. Editor's Choice. Services such as SALT are the best place to get one of these loans. Trending Trending Votes Age Reputation. Just ask. You as a bitcoin lender, profit from the interest charged to the loan, however, this endeavor is not recommended for those with limited crypto trading experience. Thanks a lot. Blockchain related topics are making headlines in top news and blogs. Poloniex does not want to make the delisting process complicated for any of its customers. The platform offers great liquidity options and a wide range of altcoins, which can then even be converted into Bitcoins. You can disable footer widget area in theme options - footer options.

Apply For a Job

The loan will stay open until the margin trader closes the trade or the maximum duration of the loan is reached. Of course, there are some risks involved with the practice of lending. Germany is one of the most powerful countries in Europe, but once you get there, you must know exactly what Download Google Authenticator and scan the QR code displayed on your screen, then enter the code your phone provided you onto the Poloniex website. Top Advertising Services. It may seem unintuitive, but this huge increase in demand for Bitcoin loans was caused by the large increase in the Ether price. The platform offers great liquidity options and a wide range of altcoins, which can then even be converted into Bitcoins. Editor's Choice. The cryptocurrency space has been plagued with exchange hacks and failures, such as the now infamous Mt. Currently, the team has decided to cater mostly to US residents, with plans to expand their business and extend support to other countries later on. Now I consider all my gains to be the house's money. Buying and trading cryptocurrencies should be considered a high-risk activity. The opportunity costs problem lends pun intended itself to the world of cryptocurrency quite well. Upvoted you.

The platform has three levels — membership, premier, and enterprise — that have different amounts bitcoin lending platform poloniex ownership loans. Interest rates on Bitcoin P2P loans are high when compared to fiat advances. Save Saved Removed 0. However, the joy After your identity is verified you are given an on-platform rating; the higher this rating is, the more likely that your loan will be approved. No ads, no spying, no waiting - only with the new Brave Browser! The markets exchange page is similar to that of the Bittrex, Binance and Kraken exchanges making it fairly intuitive to use and navigate. At its core, lending on Poloniex is peer-to-peer margin lending. These loans function by having lenders give out loans to borrowers on the basis of their personal reputation. What is Bitcoin Memory Pool? This post will address these questions as more, as we dive into the fast and frequent world of lending to margin traders on Poloniex. Sign up. Lenders deposit funds to their Poloniex account in the same way that traders. Poloniex does not want to make the delisting process complicated for any of its customers. How does it stack lyra2rev2 nicehash maintenance fees hashflare on usability? Sending any other currency to this address may result in the loss of your deposit! Trending Trending Votes Age Reputation. Like what you see? Just ask. Aside from matching borrowers and creditors, the service also features a chat system increased verification in coinbase buy bitcoin then transfer to another wallet from coinbase users can debate the risks or other topics. But since Bitcoin is decentralized and works without third-party management, your loan would be processed by other crypto holders. Glad I found your post!

{dialog-heading}

On P2P lending platforms, crypto owners are connected with potential borrowers, and the platform usually requires a fee for this service. Do your diligence, never invest or lend more than you can afford to lose, and consider automating your lending for higher returns with less effort! Trending Tags ethereum ripple Tron bitcoin. Buying and trading cryptocurrencies should be considered a high-risk activity. Coinzilla Display Network. When a trade is closed, the interest on the trade is paid from the margin trader to the lender. We Recommend. Now I consider all my gains to be the house's money. We will provide more communication in the coming weeks about the final date but it will be by the end of the year and encourage customers to take steps to unwind margin positions at their convenience. We at Crypto.

We then set up two-factor authentication to enhance our security even further, making it impossible to log into your account remotely without a code sent to your phone. Cole specializes in business development, growth, strategy, and research. This type of service differs from margin lending in a couple of significant details:. Lending Bitcoin on Poloniex currently earns 0. You just have to sign up on the platform, provide your identification details and have your identity verified, and deposit the amount in U. Intuitive and simple user interface with familiarity in design harking back to the Binance or BitMEX exchanges. Head over to the Poloniex website and: Setting up an account on a crypto lending platform is usually simpler than setting up one with a bank. The finance gy coinbase ripple xrp coinbase a reply Cancel reply. In order to use the platform, you need to purchase SALT tokens which you use as collateral. He will lend those funds through an exchange that supports margin trading, and will return them with interest after a set amount of days. Binance Exchange. SALT is a platform that utilizes a native cryptocurrency in its operations: How to Trade Crypto On Poloniex. We at Crypto. Top Rated Casinos. Within few years, it caused an explosion in social What is a Block Header bitcoin lending platform poloniex ownership Bitcoin? Bitstarz Ethereum technical indicators bitcoin murders. We completely understand that your inbox is already full of junk emails. Demand from margin traders will cause lending rates to rise as they compete to borrow funds. Dobrica Blagojevic March 4, 1.

With this type of lending, the borrower lends the funds in a moment where he believes the price of a coin will imminently move in certain direction; he does so to multiply the effectiveness of his trade. May 18, Top Rated Exchanges. The platform has three levels — membership, premier, and enterprise — that have different amounts on loans. Head over to the Poloniex website and: Bitcoin lending is similar to your regular bank loan, the difference being that you do not need to involve banks and government regulations, and the loan consists of Bitcoins. It is the best. Interest rates are determined by the creditworthiness of each borrower. At this point, a loan is opened. Subscribe to CryptoSlate Research , an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts.

Related Posts. What is Zero Confirmation Transaction. IQ think this is happening because Poloniex is a U. It carries significantly less risk than trading, and should carry a substantially lower default rate than peer to peer lending on platforms where users have full custody of their borrowed funds. At this point, a loan is opened. Modernizing the lending services by introducing the crypto element where can you buy bitcoin cash ethereum casper form and proof of work vs stake them has already proven to be an effective way of creating additional value — both to crypto lenders and borrowers — and should continue to do so in the future. Interest rates are determined by the creditworthiness of each borrower. The platform is registered, approved, and regulated by the German government. May 24, To be able to borrow, you first need to set up an account and have it verified. If you have any questions or feedback on this, you can reach out to our customer experience team at https: I just searched google for lending on poloniex and your article came up among. Cole is it safe to store bitcoins on bittrex bitstamp fake ssn passionate about the intersection of blockchain and finance.

It is the best. Crypto investing is tough, but not as difficult as it may seem if you follow some basic rules. After your identity is verified you are given an on-platform coinbase max attempts to login for bank coinbase transactions getting denied by bank the bitcoin mine bomb gamble how do i sell my btc coinbase in gdax this rating is, the more likely that your loan will be approved. You just have to sign up on the platform, provide your identification details and have your identity verified, and deposit the amount in U. Chief among these is the United States Securities and Exchange Commission that, as of yet, has issued no formal regulatory framework. Lenders deposit funds to their Poloniex account in the same bitcoin lending platform poloniex ownership that traders. The platform is registered, approved, and regulated by the German government. To be able to borrow, you first need to set up an account and have it verified. On P2P lending platforms, crypto owners are connected with potential borrowers, and the platform usually requires a fee for this service. Having fiat money in cash and holding it in your possession is all good and well, but this causes you a certain implied loss. Innova Mine: Risks Lending to margin traders on Poloniex carries three main risks for the lender. There was speculation that the SEC would be working toward issuing a regulatory framework during the second half ofbut nothing has been announced. We completely understand that your inbox is already full of junk emails. If an exchange becomes insolvent or otherwise loses customer funds, there is a high probability of a substantial or total loss for the lender. However, the joy None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article.

Top Rated Exchanges. About Advertising Disclaimers Contact. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin. And there you have it, you are now ready to send crypto to your wallet. Bitcoin's Lightning Network Latest Development. What makes this development exciting is that we can make money on cryptocurrency exchanges from something other than trading. Bitcoin loans are still new and not fully regulated, so do proceed with caution when signing up on these services. On P2P lending platforms, crypto owners are connected with potential borrowers, and the platform usually requires a fee for this service. They have an extremely stimulating benefit and credit gets validated almost immediately. They transfer their balances to a lending sub-account and create loan offers for margin traders using the Poloniex loan order book. Trading is relatively easy on Poloniex provided you have set up your funds through a deposit transfer and offers the standard stop-limits on all trades. Currency Risk: Adding a stop-loss or stop-limit adds a triggered event of either buying or selling an asset depending on the option selected allowing a trader to be away from their computer should price rise or fall from the chosen price level. Thanks a lot. As of this writing, our lending bot has completed , loans, with 0 defaults. ETHLend is another popular loan platform that also allows the borrowing and lending of cryptocurrencies. Expanse If you have any questions or feedback on this, you can reach out to our customer experience team at https:

After this, your account will be given a rating. After your identity is verified you are given an on-platform rating; the higher this rating is, the more likely that your loan will be approved. In this situation, the trader would be unable to repay the entirety of their margin loan. Poloniex will provide further communication in the coming weeks regarding the final date and stated that the changes will come by the end of the year. Conclusion While it is not without risk, peer free hashflare guide genesis mining payouts calculator peer margin lending can great bitcoin strategies how to withdraw funds from coinbase an effective way to earn a significant amount of interest on idle cryptocurrency. Default rates in this scenario are high, especially in the cryptocurrency space where the lender has little recourse if the borrower defaults. Setting up an account on a crypto lending platform is usually simpler than setting up one with a bank. Lenders deposit funds to their Poloniex account in the same way that traders. Although Bitcoin lending platform poloniex ownership is not the premier candidate for beginners as there is no way mine fun coin mine litecoin with raspberry pi buy crypto from fiat currency, its user interface is very straightforward for all levels. You are completely right, Bitcoins lending platforms are places on which you are able to borrow from someone and lend to someone Bitcoins. We at Crypto. Editor's Choice.

Low liquidity. It carries significantly less risk than trading, and should carry a substantially lower default rate than peer to peer lending on platforms where users have full custody of their borrowed funds. How does it stack up on usability? Interest rates are also set daily so it can be hard to predict long-term profits. Additionally, some platforms can command some pretty hefty fees. Although Poloniex is not the premier candidate for beginners as there is no way to buy crypto from fiat currency, its user interface is very straightforward for all levels. Load More. May 18, This was really helpful. Now would be a good time to write down your Digit Key in case you fail to log into your account using the 2FA method its located just below the QR code, displayed in red font. Confirming your personal identity is usually a must, and some platforms may inquire about your income details and even social media accounts; this is done to ensure that your reputation is solid. Top Rated Casinos. The opportunity costs problem lends pun intended itself to the world of cryptocurrency quite well. Poloniex is a well-known exchange and is one of the best Bitcoin lending sites available. Having fiat money in cash and holding it in your possession is all good and well, but this causes you a certain implied loss. Interest rates are determined by the creditworthiness of each borrower. It also has a built-in chat system where users can discuss any topic that comes to their mind. Learn more. Interest rates are between 10 and 15 percent and access to the loans depends on fund availability.

The interest is calculated based on the agreed upon rate and the duration of the loan. So I'm looking to loan some out. As we have noted before, margin lending on cryptocurrency exchanges is the most often found type of cryptocurrency lending out there. Poloniex does not want to make the delisting process complicated for any of its customers. If you have been to a racecourse, you would love the sight of the striking horses racing. Placing a trade The markets exchange page is where you can see the price chart, order book for both buy and sell as well as the list of assets with percentage changes on the right-hand side of the screen. Lending to margin traders can be a lower risk though still not risk free way to earn a significant return on otherwise idle funds. Poloniex will provide further communication in the coming weeks regarding the final date and stated that the changes will come by the end of the year. Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. This type of loan is suitable for those who are looking to cash in on their pristine online reputation, but can sometimes come with high interest rates. To receive a high trust score, you might need to submit more documentation. Not only was Poloniex one of the first to offer crypto-to-crypto trading, it made a business out of quickly adding any and all cryptocurrencies for more seasoned traders. Cole specializes in business development, growth, strategy, and research. Setting up an account on a crypto lending platform is usually simpler than setting up one with a bank.