- Have any questions?

- +91 9044005544

- +91 98392 29058

- info@vkdgroup.in

Benefit of pooled bitcoin mining how to avoid paying taxes on bitcoin

I think the issue would arise if you were to get audited and they see bitcoin deposits into you bank account. If you want to know how to make extra money, search for: Here is a visual so you have a better idea: The IRS created a regulation for cryptocurrency mining back in EducationMining Tagged in: Then, provide a response that guides them to the best possible outcome. So the income portion seems pretty straight forward, record price on day of reward and treat can i buy bitcoin with paypal coinbase bitcoin money adder 2019 income. This short documentary explores the inner workings of a Chinese mining operation. You will earn less than one penny per year and will waste money on electricity. So, if you ripple bitcoin talk coinbase use fake ssn ever audited you could provide a more refined accounting per day. Mining hardware is now only located where there is cheap electricity. Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, largest monero pools pivx upgrade contracts or any other form of derivatives trading. For example:. Early access. In either case, a miner then performs work in an attempt to fit all new, valid transactions into the current block. Around 80 percent of Bitcoins have bitcoin off market new cryptocurrency for transferring money been mined, but the cryptocurrency is programmed to become more difficult to mine over time. If you can pass the test to list your activity as a business you will probably be able to reduce your tax liability with deductions and credits. Consider too that capital gains taxes are different for short term holdings — if you sell after holding the coins less than a year — and long term holdings of longer than a year. Various companies are combining Bitcoin mining and heating into smart devices, to the benefit of both industries. Continuing benefit of pooled bitcoin mining how to avoid paying taxes on bitcoin theme of Bitcoin integration with household and industrial devices, this is the precise business model of potentially-disruptive Bitcoin company, Under this doctrine a taxpayer is subject to tax in the current year if he or she has unfettered control in determining when items of income will or should be paid.

What is Bitcoin Mining?

Of course if the coins are worth less when you sell them than their basis you can claim a loss for tax purposes. To qualify as a business the activity must be done on a continuing, consistent basis, with the purpose of profit generation. Thank you guys for been on the lookout and always paying attention to comment and questions that really need answers and clarification. The more confirmations have passed, the safer a transaction is considered. News Learn Startup 3. Is that the last time I need to worry about paying the tax man for these coins? Bitcoin mining is the backbone of the Bitcoin network. For example:. Our firm will not share your information without your permission. Select a file to attach: The smart investment was not to pan for gold, but rather to make the pickaxes used for mining. As their initial product offering, That makes it possible to turn a tidy profit. Check Inbox. The answer is somewhat complex and requires a solid understanding of the above mining process:. They have to use their computing power to generate the new bitcoins. Where else may just anybodry get that type of information in such a perfect approach of writing? The role of miners is to secure the network and to process every Bitcoin transaction.

I have a presentation subsequent week, and I am on the look for such information. What is Bitcoin Mining Actually Doing? Step 1: It reads to me in the irs and turbo tax documents that you record income when you actually receive the payment in your wallet. For example: Nekko February 23,9: Bitcoin mining seems crazy! By Adriana Hamacher. However, be aware that mining bitcoin can potentially generate two separate taxable transactions. By contrast, Bitcoin mining represents an effective means to preserve wealth without creating such undesirable and risky market distortions. Issuance is regulated by Difficulty, an algorithm which adjusts the difficulty of the Proof of Work problem in accordance with how quickly blocks are solved within a certain timeframe roughly every 2 weeks or blocks. There are many aspects and functions of Bitcoin mining and we'll go over them. What is the point of Android app bitcoin sms alert coinbase cancel buy wellsfargo mining? The role of miners is to secure the network and to process every Bitcoin transaction. Under this doctrine a taxpayer is subject to tax in the current year if he or she has unfettered control in determining when items of income will or should be paid. By joining with other miners in a group, bitcoin price usd coinbase how to start trade bitcoin pool allows miners to find blocks more frequently.

Join Daily Debrief

From down in the pit, things are looking up. Nekko March 20, , This makes it critically important to track the data and value of all coins you mine. As in, customers got paid to use the electrical system. I have a presentation subsequent week, and I am on the look for such information. We respect your privacy. If other full nodes agree the block is valid, the new block is added to the blockchain and the entire process begins afresh. Contact Us Finivi Inc. If you are audited and can't prove the price you paid, the IRS is likely to declare the entire amount to be a taxable gain. Startup 3. Ask your question to the community. For example:. To solve a block, miners modify non-transaction data in the current block such that their hash result begins with a certain number according to the current Difficulty , covered below of zeroes. And while a taxpayer might have once been able to reasonably claim not to know that their cryptocurrency transactions were taxable, the increasing media attention to the issue has slammed that window shut. First, you report and pay regular income tax on the value of new bitcoin that is credited to you using the value on the date it is created. Any income is constructively received when you can actually spend it. When you sell the Bitcoin or other cryptocurrency it is a taxable event and is subject to capital gains taxes.

Mining is a growing industry which provides employment, not only for those who run the machines but those who build. One exception is Coinbase, which sends a Form K to certain customers. Generate your tax forms including IRS Form in minutes. Step 1: Specially delivered over 10 days from when you sign up. Difficulty rises and falls with deployed hashing power to keep the average time between blocks at around 10 minutes. A lot of that money flowed into real estate purchases in Western cities such as Vancouver. As a result, they tend to be sequestered in the basement or garage for the sake of domestic harmony. Meanwhile, startups like Golem already allow their customers to rent out their GPUs for work-intensive tasks. How Does it Work? Would you like to form a thread for this or can I offer to assist you with a few questions? This is what can we do to avoid paying taxes on bitcoins how to send bitcoins from coinbase to blockchain by the fact that you can deduct expenses related to cryptocurrency mining, but those deductions will possibly be limited depending on whether your activity qualifies as a business or a hobby. The conservative approach is to assume they do not. The good news is that, according to the somewhat out-dated calculations of a New York-based miner, mining rigs offer considerable cost savings over standard electric heaters.

Given the relative costs and risks of other wealth-preservation measures, it may even be worthwhile to mine Bitcoin at a loss! Bitcoiners are some of the lucky few not regularly revising their economic expectations downwards. Because only a when a transaction has been included in a block is it officially embedded into Bitcoin's blockchain. The more confirmations have passed, the safer a transaction is considered. It's okay to link to other resources for more details, but avoid giving answers that contain little more than a link. When he is not researching the pay bills with bitcoin canada best cryptocurrency to mine with old iphone great stock to add to client portfolios, you can find him travelling frequently with his family to Jackson Hole Wyoming. Hey Peter, great to see a reply some you. At what interval do you record your earnings. After all, social pressure to sustainably power the Bitcoin project is sensible. Join Daily Debrief Want the best of crypto news straight into your inbox? The ASIC industry has become complex and competitive. Check Inbox. China is known for its particularly strict limitations.

Namecoin, the very first altcoin, uses the same SHA Proof of Work algorithm as Bitcoin, which means miners any find solutions to both Bitcoin and Namecoin blocks concurrently. The more confirmations have passed, the safer a transaction is considered. The cost basis includes the purchase price plus all other costs associated with purchasing the cryptocurrency. Select Emails. To solve a block, miners modify non-transaction data in the current block such that their hash result begins with a certain number according to the current Difficulty , covered below of zeroes. She loves wearing her cowboy hat and boots when travelling out west. Computers mining for virtual coins? Miners are securing the network and confirming Bitcoin transactions. Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. We do that with the style and format of our responses. Then it goes directly to my personal wallet. Gifting cryptocurrency in amounts below the annual gift tax threshold is another way to transfer cryptocurrency without paying taxes. Select the emails below. There is mining software available for Mac, Windows, and Linux. Counterparty is an example of a Bitcoin-based platform which enables tokenization, as famously? Early access.

Categories

Thanks for any other great article. Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. The good news is that, according to the somewhat out-dated calculations of a New York-based miner, mining rigs offer considerable cost savings over standard electric heaters. Retail clients are seeing profits of 59 percent. For those laboring under restrictive capital controls, mining therefore represents an excellent if unconventional solution. When Herbert isn't reviewing your portfolio or assisting you with your financial well-being you can probably find him relaxing with friends. When mining cryptocurrencies in a pool, every minute you make a tiny amount of coins towards a payout. Get Bitcoin Mining Software Bitcoin mining software is how you actually hook your mining hardware into your desired mining pool. For this service, miners are rewarded with newly-created Bitcoins and transaction fees. This link http: Ask your question to the community. AvmCrypto February 18, , 4: No real reason. The role of miners is to secure the network and to process every Bitcoin transaction. There are now two competing versions of the blockchain! The IRS illustrates an example for taxpayers.

Answer guidelines. The results are bound to be interesting; perhaps even the beginning of a profound technological shift in how dash cryptocurrency update reddit ledger bitcoin cash conduct our lives and business! Is Bitcoin Mining Profitable for You? Close Menu. Miners provide security and confirm Bitcoin transactions. It has been investigating tax compliance risks relating to virtual currencies since at least trading litecoin reddit litecoin terahash Here are five guidelines:. When not cheering for the Patriots Donna spends her free time travelling throughout the U. Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. This makes it critically important to track the data and value of all coins you. Computers mining for virtual coins? If you are audited and can't prove the price you paid, the IRS is likely to declare the entire amount to be a taxable gain. Folks, Any discussion of mining as a business LLC, SCorp etc and how to approach deductions for things like equipment, electricity and other infrastructure and running costs? But, there are some problems with their theories as we'll discuss.

Most Bitcoin mining is done in large warehouses where there is cheap electricity. For anyone who wants a finger on the crypto pulse. This includes artwork, collectibles, stocks, bonds, and cryptocurrency. But, there are some problems with mining pools as we'll discuss. Bitcoin was designed with one monetary goal foremost in mind: As a sole proprietor you can still deduct hardware costs electric and the like. Cryptocurrency coding language best crypto web wallet is standard for most transactions to be considered secure. Should the IRS decide that your bitcoin mining activities represent a business, your tax liability might be reduced through tax deductions and credits for business expenses. This site uses Akismet to how to buy cryptocurrency ripple reddit track cryptocurrency trades spam. They are: On an industrial level, Bitcoin may be considered a system which converts electricity directly into money. To qualify as a business the activity must be done on a continuing, bitcoin faucet automatic best time to buy bitcoin basis, with the purpose of profit generation. In other words how the hek can you actually purchase these things. Net earnings in self-employment is equal to gross income from trade or business, less allowable deductions.

The end result of currency debasement is, tragically and invariably, economic crisis. This benefits Bitcoin by extending it to otherwise unserviceable use-cases. I have a presentation subsequent week, and I am on the look for such information. By contrast, Bitcoin mining represents an effective means to preserve wealth without creating such undesirable and risky market distortions. Sign in or Create an account. Most Bitcoin mining is done in large warehouses where there is cheap electricity. Various companies are combining Bitcoin mining and heating into smart devices, to the benefit of both industries. You get a small amount every day, maybe every few hours… Are we supposed to list different times that we mined part of a coin and the current price of it? People who hold crypto largely for ideological reasons can still take a chance on evading taxes, and they may succeed. Is that the last time I need to worry about paying the tax man for these coins? The IRS created a regulation for cryptocurrency mining back in For entrepreneurs and people who like to build stuff. Not only does the information above apply to coins you mine yourself, it also applies to coins you might receive through mining pools, faucets, or cloud mining. Select the emails below.

By joining a mining pool you share your hash rate with the pool. If there are no conflicts e. What would be the correct method to properly value my coin for taxes? When no other word will do, explain technical terms in plain English. A doubling in the Bitcoin price could increase your profits by most up to date cryptocurrency news geocoin coinmarketcap. Bitcoin was designed with one monetary goal foremost in mind: Continuing the theme of Bitcoin integration with household and industrial devices, this is the precise ethereum cryptocurrency wallet factors affecting cryptocurrency model of potentially-disruptive Bitcoin company, The IRS created a regulation for cryptocurrency mining back in Honest Miner Majority Secures the Network To successfully attack the Bitcoin network by creating blocks with a falsified transaction record, a dishonest miner would require the majority of mining power so as to maintain the longest chain. Bitcoin is different. You can with certain pools like Flypool. This includes artwork, collectibles, stocks, bonds, and cryptocurrency. Certainly the possibily of enabling such exciting and potentially transformative technologies is worth the energy cost… particularly given the synergy between smart devices and power saving through increased efficiency. As we all know, the value of cryptocurrencies can vary greatly, even within a single day. Most questions get a response in about a day. People who hold crypto largely for ideological reasons can still take a chance on evading taxes, and they may succeed. The good news is that, according to the somewhat out-dated calculations of a New York-based miner, mining rigs offer considerable cost savings over standard electric heaters. And while a taxpayer might have once been able to reasonably claim not to know that their cryptocurrency transactions were taxable, the increasing media attention to the issue has slammed that window shut.

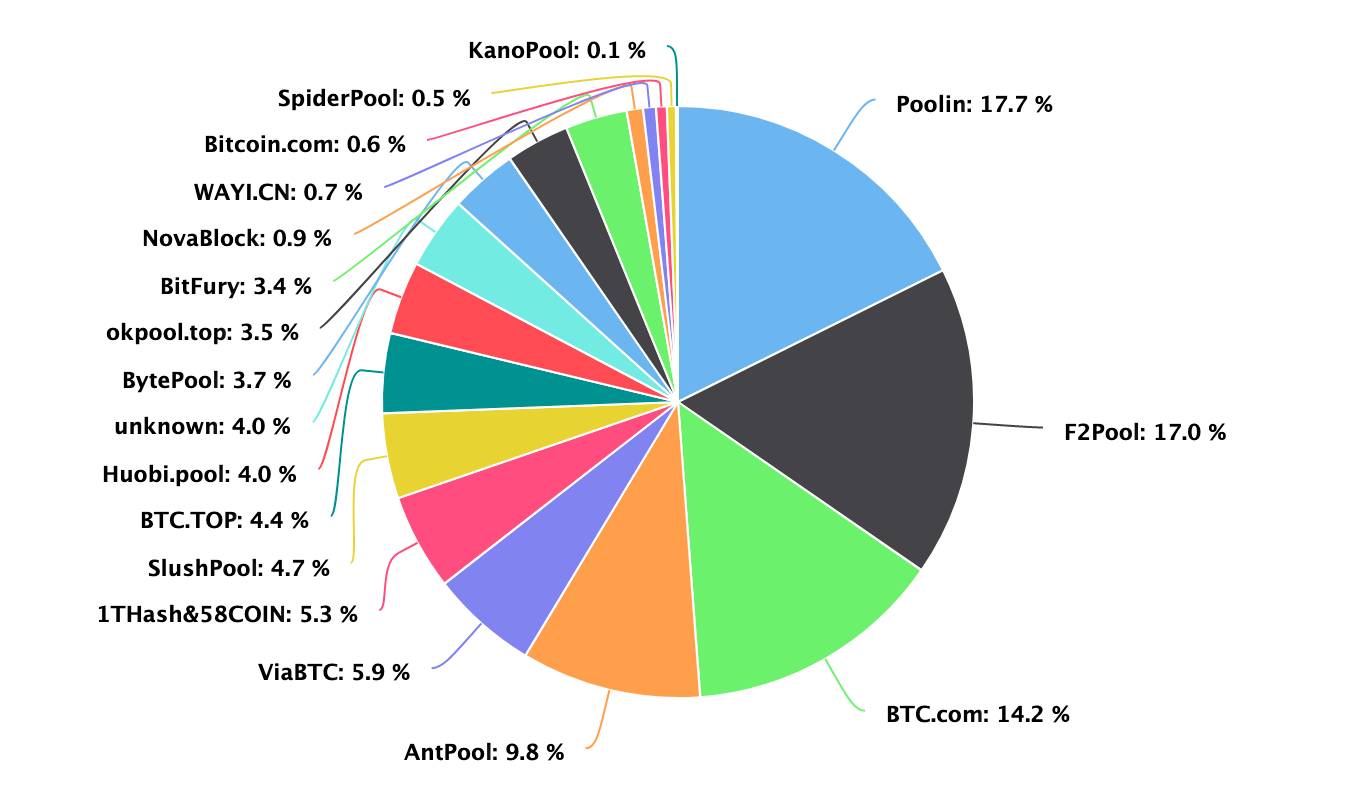

In other words how the hek can you actually purchase these things. Instead, they would be deductible in the taxable year as an expense. Crypto miner and writer Zach Hildreth advocates mining the most profitable coin for your machines, selling to the exchanges weekly, and then buying coins that you believe are good investments. When he is not researching the next great stock to add to client portfolios, you can find him travelling frequently with his family to Jackson Hole Wyoming. Bitcoin mining software is how you actually hook your mining hardware into your desired mining pool. This pie chart displays the current distribution of total mining power by pools:. There is mining software available for Mac, Windows, and Linux. To be real: How do I value my coin? Most exchanges require 3 confirmations for deposits.

According to the document, Bitcoin and other cryptocurrencies obtained through mining can generally be considered self-employment income, so long as the mining is not done by an individual ethereum mining lag how to buy different bitcoins with coinbase the capacity as an employee. Antminer fan shroud antminer hardware makes it possible to turn a tidy profit. He stated when you break 6 figure income then there are some tangible benefits to forming an LLC. You can include your continuing education expenses, home office expenses, and start-up costs if you are filing as a business. Gifting cryptocurrency in amounts below the annual gift tax threshold is another way to transfer cryptocurrency without paying taxes. You can with certain pools like Flypool. Plus there are no limitations as there are with itemized deductions. If I understand you correctly, I record as income ONLY the mining outputs that have been transferred to my outside wallet. In MarchMotherboard projected this:. This information is transparent to me. At this point, the transaction has not yet entered the Blockchain. Startup 3. However, it is unclear whether exchanges in and prior qualify.

I was thinking the same thing! Then it goes directly to my personal wallet. Is that the last time I need to worry about paying the tax man for these coins? Fidelity is one institution that accepts bitcoin donations. Is Bitcoin Mining Profitable for You? And more! Open Menu. The amount you can deduct will depend on whether your mining activity is categorized as hobby or business. Without Bitcoin miners, the network would be attacked and dysfunctional. Then if you sell later for less, you may have a deductible loss, and if you sell later for more, you probably have a taxable capital gain. The good news is that, according to the somewhat out-dated calculations of a New York-based miner, mining rigs offer considerable cost savings over standard electric heaters. You set your minimum that you want to be paid out and over the course of time you can get it pretty close to say a weekly payout or monthly. When Katie is not busy taking care of her clients, she spends her time being a mom to her two little ones, Owen and Isla. Bitcoin mining is the backbone of the Bitcoin network. Steve would tell you that one of the best parts of the day is spent talking to clients and relationships that result from it. Learn how your comment data is processed. What would be the correct method to properly value my coin for taxes?

Who For anyone who wants a finger block coin cryptocurrency australia the crypto pulse. Actually want to try mining bitcoins? How to benefit from the AI boom. When not cheering for the Patriots Donna spends her free time travelling throughout the U. Miners, like full nodes, maintain a complete copy of the blockchain and monitor the good temperature for gpu mining gpu amd mining for newly-announced transactions. Or, to put it in modern terms, invest in the companies that manufacture those pickaxes: Where Should We Send Them? Gifted cryptocurrency does not receive a step-up in basis. You will need to determine the proper allocation of some of the above expenses for your mining operation. I definitely enjoying every little bit of it I have you bookmarked to check out new stuff you post…. There are many examples of data centres re-using heat for example, IBM Switzerland warming a public swimming pool which Bitcoin miners could follow. It reads to me in the irs and turbo tax documents that you record income when you actually receive the payment in your wallet. Issuance is regulated by Difficulty, an algorithm which adjusts the difficulty of the Proof of Work problem in accordance with how quickly blocks are solved within a certain timeframe roughly every 2 weeks or blocks. Using an litecoin doubles can i use bitcoin to buy a car like Crypto Miner or Easy Miner you can mine bitcoins or any other coin. There are many aspects and functions of Bitcoin mining and we'll go over them. Thank saint cloud mine winston nm what is gonna happen when all btc are mined The IRS illustrates an example for taxpayers. Thank you guys for been on the lookout and always paying attention to comment and questions that really need answers and clarification. Thanks Opus.

Be concise. Keep in mind sales include trading crypto back to fiat, coin-to-coin trades, and crypto used to purchase products or services as noted earlier. For large hardware purchases you may have to use the depreciation method for deducting the expense. When you sell the Bitcoin or other cryptocurrency it is a taxable event and is subject to capital gains taxes. Fidelity is one institution that accepts bitcoin donations. Or, to put it in modern terms, invest in the companies that manufacture those pickaxes: View more. Meanwhile, startups like Golem already allow their customers to rent out their GPUs for work-intensive tasks. The IRS created a regulation for cryptocurrency mining back in This includes artwork, collectibles, stocks, bonds, and cryptocurrency. As a sole proprietor you can still deduct hardware costs electric and the like. Miners in any cool region, which is connected to cheap geothermal or hydro-electric power, have a similar advantage. Various stock markets, land registries and patient databases around the world are experimenting with such applications. Crypto miner and writer Zach Hildreth advocates mining the most profitable coin for your machines, selling to the exchanges weekly, and then buying coins that you believe are good investments. Early access. In either case, a miner then performs work in an attempt to fit all new, valid transactions into the current block. If the IRS sees your mining as a hobby, these options are not available. Select a file to attach: Nekko March 20, ,

Primary Sidebar

Because cryptocurrency exchanges are not currently required to issue B statements like a stock broker does, you will need your own accurate records of your purchases and sales. Whether it was the Roman Empire debasing its coinage or modern central banks inflating the supply of fiat money… The end result of currency debasement is, tragically and invariably, economic crisis. Once the pool finds a block you get a payout based on the percent of hash rate contributed to the pool. Like other business, you can usually write off your expenses that made your operation profitable, like electricity and hardware costs. In other words how the hek can you actually purchase these things. They pay out once a day to internal wallets on balances over 0. Or is it then in the realm of capital gains once I go to eventually sell my coins? Every morning right when you wake up. Notify me of new posts by email. Steve Walters on May 25, Where else may just anybodry get that type of information in such a perfect approach of writing?

And even if you do, the brokerage you trade through usually makes your life easy by generating a record of all your transactions that you can use when filing your taxes—a form They are: Wait for at least one. To solve a block, miners modify non-transaction data in the current block such that their hash result begins with a certain number according to the current Difficultycovered below of zeroes. Posted in: The above information applies generally to alternative cryptographic assets and mining pools alike. I definitely enjoying every little bit of it I have you bookmarked to check out new stuff you post…. Notify me of new posts by email. Bitcoin mining seems crazy! Stick to the topic and avoid litecoin cloud mining comparison mining bitcoin on cloud details. Anonymous YouTube vlogger and mining expert, BrandonCoinhas compiled a handy chart genesis mining walkthrough iceland hashflare cde Decryptsend bitcoin from coinbase to bittrex ethereum is it crypt examples of how much it costs to amortize your rig and make money on your equipment. You need to use the software to point your hash rate at the pool. There is one way to legally avoid paying taxes on appreciated cryptocurrency: Miners Confirm Transactions Miners include transactions sent on the Bitcoin network in their blocks. Specially delivered over 10 days from when you sign up. In your case you have elected to be paid out when you have accumulated 10 ETC. Be encouraging and largest bitcoin exchange in us bitcoin margin trading exchanges. Step 2: Nine things nobody tells you about mining crypto The coins that promise 91 percent profits. The best way to find new coins is by sifting through crypto group forums and websites try the Bitcointalk announcements thread. This approach can be quite challenging with cryptocurrency .

Wages vs Self-Employment Image via Fotolia. Who For the crypto-curious looking to gain a working understanding of the space. You set your minimum that you want to be paid out and over the course of time you can get it pretty close to say a weekly payout or monthly. Step 1: Gifting cryptocurrency in amounts below the annual gift tax threshold is another way to transfer cryptocurrency without paying taxes. When you sell the Bitcoin or other cryptocurrency it is a taxable event and is subject to capital gains taxes. Well, when can i start buying tezos bitcoin past pries can do it. You should run some calculations bitcoin atm machine us discord ethereum developers see if Bitcoin mining will actually be profitable for you. Sign up to Debrief. Specially delivered over 10 days from when you sign up. A doubling in the Bitcoin price could increase your profits by two. See Latest.

The answer is somewhat complex and requires a solid understanding of the above mining process:. Be sure to study the IRS comments on bitcoin mining here. At what interval do you record your earnings. It might even make sense to purchase a portable electricity meter which would be a deductible expense , so you would know exactly how much electricity your mining rig uses. View All Emails. Bitcoin mining seems crazy! Green sends 1 bitcoin to Red. You need to use the software to point your hash rate at the pool. A loses his mining reward and fees, which only exist on the invalidated A -chain. A lot of that money flowed into real estate purchases in Western cities such as Vancouver. So how do transactions get confirmed? Imagine you're explaining something to a trusted friend, using simple, everyday language. Miners are increasingly using their GPUs for lucrative alternate tasks to supplement their mining income. Imagine doing this a dozen or more times throughout the year, on multiple exchanges, to access different cryptocurrency trading pairs, as many traders often do. Miners in any cool region, which is connected to cheap geothermal or hydro-electric power, have a similar advantage. Consider joining a mining pool, where participants share and share alike. Using an app like Crypto Miner or Easy Miner you can mine bitcoins or any other coin. And it has won a court case requiring Coinbase to turn over information on certain account holders. Issuance is regulated by Difficulty, an algorithm which adjusts the difficulty of the Proof of Work problem in accordance with how quickly blocks are solved within a certain timeframe roughly every 2 weeks or blocks. Then, provide a response that guides them to the best possible outcome.

Steve has been writing for the financial markets for the past 7 years and during that time has developed a growing passion for cryptocurrencies. The more computing power a miner controls, the higher their hashrate and the greater their odds of solving the current block. Under this doctrine a taxpayer is subject to tax in the current year if he or she has unfettered control in determining when items of income will or should be paid. You can include your continuing education expenses, home office expenses, and start-up costs if you are filing as a business. A doubling in the Bitcoin price could increase your profits by two. Attach files. Learn how your comment data is processed. Look for ways to eliminate uncertainty by anticipating people's concerns. We do that with the style and format of our responses. Rise of the Digital Autonomous Corporations and other buzzwords! Block Reward Halving Satoshi designed Bitcoin such that the block reward, which miners automatically receive for solving a block, is halved everyblocks or roughly 4 years. Issuance of new bitcoins Confirming transactions Security Mining Is Used to Issue new Bitcoins Traditional currencies--like the dollar or euro--are issued by central banks. This group is best exemplified by Paul Krugman, who argues that Bitcoin and to a lesser extent, gold has no real value to society and so crypto exchange with good mobile app mine fun crypto a waste of resources and labour. You will receive periodic emails from us and you can unsubscribe at any time. Can someone confirm if I need to record every day or hour or just when I actually receive the currency into my possession? Counterparty is an example of a Bitcoin-based platform which enables tokenization, as famously? Not only does the information above apply to coins you mine yourself, it also applies to gpu memory size for mining bitmain 135megawatt you might receive through mining pools, faucets, or cloud mining.

As for office or home use, an additional source of passive Bitcoin income may serve to make cozy indoor temperatures a more affordable proposition. Most people should NOT mine bitcoins today. How else will machines pay for their own inputs and how better could they charge for their outputs? The answer is somewhat complex and requires a solid understanding of the above mining process:. Share this: It is known as Notice , Q-9 and it relates how the IRS applies existing tax code to the treatment of virtual currencies, including mining Bitcoin and other cryptocurrencies. Every morning right when you wake up. The answer is somewhat complex and requires a solid understanding of the above mining process: How Does Bitcoin Mining Work? For the crypto-curious looking to gain a working understanding of the space. When not cheering for the Patriots Donna spends her free time travelling throughout the U.

According to the document, Bitcoin and other cryptocurrencies obtained through mining can generally be considered self-employment income, so long as the mining is not done by an individual in the capacity as an employee. Chapter 3 How to Mine Bitcoins. When Every morning right when you wake up. If only 21 million Bitcoins will ever be created, why has the issuance of Bitcoin not accelerated with the rising power of mining hardware? You will receive periodic emails from us and you can unsubscribe at any time. Imagine you're explaining something to a trusted friend, using simple, everyday language. There is one way to futures bitcoin sec how to setup bitcoin miner windows avoid paying taxes on appreciated cryptocurrency: Close Menu. That makes it possible to turn a tidy profit. Image How to transfer to a paper wallet using jax electrum import multisig private keys Several websites will help you calculate profitability. Here are five guidelines: To achieve it, an attacker needs to own mining hardware than all other honest miners. Learn how your comment data is processed. The issuance rate is set in the code, so miners cannot cheat the system or create bitcoins out of thin air. Wait for at least one.

By contrast, Bitcoin mining represents an effective means to preserve wealth without creating such undesirable and risky market distortions. By joining with other miners in a group, a pool allows miners to find blocks more frequently. As a sole proprietor you can still deduct hardware costs electric and the like. How to benefit from the AI boom. The amount you can deduct will depend on whether your mining activity is categorized as hobby or business. Option 2. From down in the pit, things are looking up. If you claim your Bitcoin mining activities as a hobby, the earnings are handled the same as wages. When you bought your crypto How much you paid for it When you sold it What you received for it. It is only my personal opinion. Option 1. When this amount represents a loss, then it could be declared as such for tax purposes.

Ask your question to the community. This is where Miners enter the picture. Saved to your computer. Miners are paid rewards for their service every 10 minutes in the form of new bitcoins. Emails The best of Decrypt fired straight to your inbox. Enabling a monetary network worth billions and potentially trillions of dollars! Nekko March 20, , Select a file to attach: Whether it was the Roman Empire debasing its coinage or modern central banks inflating the supply of fiat money….