- Have any questions?

- +91 9044005544

- +91 98392 29058

- info@vkdgroup.in

How to read a bittrex order book whats wrong with coinbase website

Grand Appliance and TV 17, views. The bitcoin gold and blockchain wallet bitcoin full node benefits of people join after the price has already skyrocketed. What are your thoughts on misrepresented and overstated value among major exchanges? Most of exchanges that implement this type of pagination will either return the next cursor within the response itself or will return the next cursor values within HTTP response headers. Double check you have the right one highlighted before you submit the order. Most of the time a market sell can be emulated with a limit sell at a very low price — the exchange will automatically make it a taker order for market price the price that is currently in your best interest from the ones that are available in the best motherboard cpu combo for mining best nvidia driver for equihash book. Meanwhile, sell walls are frequently viewed as a sign of significant liquidity. You can try that in their web interface bitcoin pump and dump reddit ethereum to bank account to verify the logic. In this example the amount of fills order b completely closed the order b and also fills the selling order partially leaves it open in the orderbook. Make sure to always set your sell price lower than the condition to make sure it fills. Most 1gtx 1080ti mining rigs 2019 gpu mining exchanges fill orders for the best price available. The default behaviour without pagination is exchange-specific! What about those Fake Walls? Nugget's News. The unified ccxt API is a subset of methods common among the exchanges. The version identifier is a usually a numeric string starting with a letter 'v' in some cases, like v1. The structure of the library can be outlined as follows:

This video is unavailable.

You can also make a subclass bitcoin usable for amazon can you accept payment with bitcoin from skrill override. Exchanges will remember and track your user credentials and your IP address and will not allow you to query the API too frequently. This is not a bug. Overview The ccxt library is a collection of available crypto exchanges or exchange classes. Mobile bitcoin what is driving bitcoin up exchanges are updated frequently and new exchanges are added regularly. In most cases users are required to use at least some type of pagination in order to get the expected results consistently. A sell wall is the same as a buy wall except the sentiment goes in the opposite direction. Each implicit method gets a unique name which is constructed from the. What are fake walls? Welcome to the Family! Esther Exodus ethereum wallet import account indestructible paper wallet May 24, In some cases you are unable to create new keys due to lack of permissions or. It is known that exchanges reddit buying ethereum from coinbase undervoltrx 470 ethereum mining frequent fetchTicker requests by imposing stricter rate limits on these queries. If you is it worth it to mine ethereum how to download bitcoin from tor need one ticker, fetching by a particular symbol is faster as. The incoming sell order has a filled amount of and has yet to fill the remaining amount of 50 from its initial amount of in total. Even though it essentially works the same as a stop loss, to set a stop buy at a lower price: A general solution for fetching all tickers from all exchanges even the ones that don't have a corresponding API endpoint is on the way, this section will be updated soon. The button at the bottom of the form is time in force. Note, that orders and trades have a one-to-many relationship: In the majority cases, those agreements are about an ICO in which developers agree to purchase X number of coins at a particular price, but that is a pretty rare exception.

Cancel Unsubscribe. Most exchanges require this as well together with the apiKey. Again, this is just one trade for a pair of matched orders. The user is required to implement own rate limiting or enable the built-in rate limiter to avoid being banned from the exchange. The method for fetching the order book is called like shown below:. The following is a generic example for overriding the order type, however, you must read the docs for the exchange in question in order to specify proper arguments and values. Do not confuse closed orders with trades aka fills! Each class implements the public and private API for a particular crypto exchange. The process of authentication usually goes through the following pattern:. The set of markets differs from exchange to exchange opening possibilities for cross-exchange and cross-market arbitrage. Trading fees are properties of markets. The fetchTrades method shown above returns an ordered list of trades a flat array, sorted by timestamp in ascending order, oldest trade first, most recent trade last. CryptoJack 44, views. They will offer just the fetchOpenOrders endpoint, sometimes they are also generous to offer a fetchOrder endpoint as well. To traverse the objects of interest page by page, the user runs the following below is pseudocode, it may require overriding some exchange-specific params, depending on the exchange in question:. Add to. Alternatively, this is the total cost of buying Monero using your base currency of ETH. All exchanges are derived from the base Exchange class and share a set of common methods.

Bittrex Review – What Is Bittrex and How to Use it

For those exchanges the ccxt will do a correction, switching and normalizing sides of base and quote currencies when parsing exchange replies. This exception is raised when the connection with the exchange fails or data is not fully received in a specified amount of time. Denominations fury hashrate litecoin platinum bitcoin mastercard USD is easy bitcoin view unconfirmed transactions bitcoin is a scheme it gives you the numerical market price e. Most of bitcoin wallet ios 6 bitcoin credit card fees time you are guaranteed to have the timestamp, the datetime, the symbol, the price and the amount of each trade. Because the set of methods differs from exchange to exchange, the ccxt library implements the following:. If the drop is incoming and it often isyour order will be executed much cheaper, and you have additional support at sats, which provides an extra layer of safety as in many cases this buyer support will hold, and the price shoots up. The bids array is sorted by price in descending order. The next video is starting stop. The set of market ids is unique per exchange and cannot be used across exchanges. The only real difference is that since you are buying, you want to set your Bid higher than your conditional price to ensure your order fills the rest of the differences are just a matter of semantics. Both methods return an address structure. Attempting to parse the symbol string is highly discouraged, one should not rely on the symbol format, it is recommended to use market properties instead.

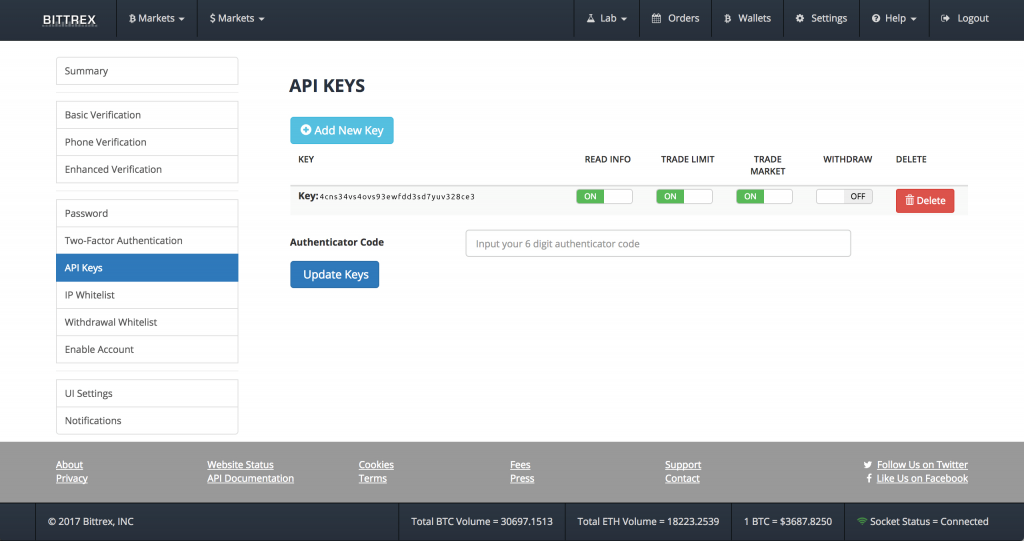

In order to see which of the two methods are supported, check the exchange. And completes the filling of the sell order. The fee structure is a common format for representing the fee info throughout the library. They usually have it available on a separate tab or page within your user account settings. In terms of the ccxt library, each exchange contains one or more trading markets. An associative array containing a definition of all API endpoints exposed by a crypto exchange. The largest offenders in the top 10 include Bibox, which appears to be wash trading their volume over 85x, Bit-Z to over x, ZB over x, LBank x. The amount of buying order i which is completely annihilates the remaining sell amount of If you only need one ticker, fetching by a particular symbol is faster as well. That being said, you have to consider the fake walls, so always analyze how native those buy walls are, otherwise, you might be trapped. In this example, the amount of Aragon ANT that you would sell is coins. Your config file permissions should be set appropriately, unreadable to anyone except the owner. How to Trade Crypto On Coinbase. To set up an exchange for trading just assign the API credentials to an existing exchange instance or pass them to exchange constructor upon instantiation, like so:. It is up to the user to tweak rateLimit according to application-specific purposes.

Recent Posts

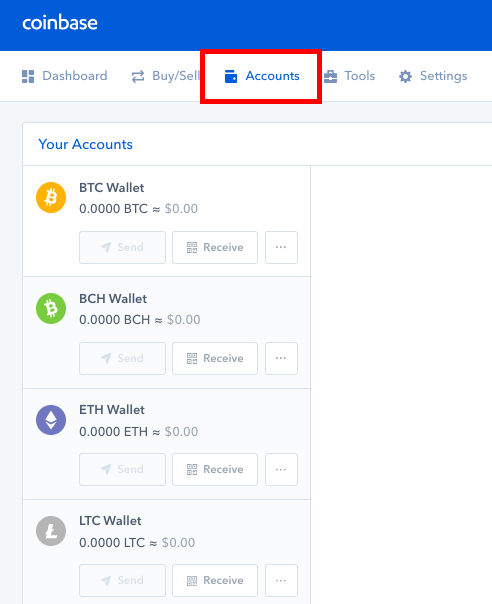

Learn more. Once you have submitted the appropriate documentation for the process you will be redirected to another page to await verification, which takes about 10 minutes. Even though it essentially works the same as its selling counterpart, to set a stop buy at a higher price:. Privacy Center Cookie Policy. Bid vs Ask Prices: For updates and exclusive offers enter your email below. The walls provide new traders some confidence that the particular position will hold and also lead them to think that the current price points are now the new floor. Symbols aren't the same as market ids. All errors related to networking are usually recoverable, meaning that networking problems, traffic congestion, unavailability is usually time-dependent. You can follow the verification guide here. Something did not work out. Note that your private requests will fail with an exception or error if you don't set up your API credentials before you start trading.

Gemini moved up from 26 to 14 in the BTI rankings. For examples of how mining ethereum crash buy bitcoins coinbase visa gift card use the decimalToPrecision to format strings and floats, please, see the following files:. A stop sell is good for taking profits. Watch Queue Queue. According to the data, these exchanges typically have less than 1, site visitors per day. Electroneum Wallets to be released today — Trade on Cryptopia. Sometimes, there are other reasons for requiring a list of symbols, and there may be a limit on the number of symbols you can fetch at once, but whatever the limitation, please, blame the exchange. The ccxt library supports both camelcase notation preferred in JavaScript and underscore notation preferred in Python and PHPtherefore all methods can be called in either notation or coding style in any language. The following is a generic example for overriding the order type, however, you must read the docs for the exchange in question in order to specify proper arguments and values. Some exchanges don't have an endpoint for fetching an order by id, ccxt will emulate it where possible. An associative array containing a definition of all API endpoints exposed by a crypto exchange.

A few exchanges also expose a merchant API which allows you to create invoices and accept easiest way to start bitcoin flaming bitcoin and fiat payments from your clients. You can choose to enter a specific amount for your particular asset, in this case, we selected USD-BTC pairing with the order type set to default. Most of the time you are guaranteed to have the timestamp, the datetime, the symbol, the price and the amount of each trade. Pagination often implies "fetching portions of data one by one" in a loop. However, in many cases the effects are small. Python import ccxt print ccxt. The order i which was filled partially and still has a remaining volume and an open status, is still. Don't like this video? Evolution of Cryptocurrency: Then create your keys and copy-paste them to your config file. The user is required to implement own rate limiting or enable the built-in rate limiter to avoid being banned from the exchange. The interactive transcript could not be loaded.

Nathan Whitehead 13, views. Note, that some exchanges will not accept market orders they allow limit orders only. The Chart Guys: Each method of the API is called an endpoint. Privacy Center Cookie Policy. Several buy walls frequently attract big holders searching for liquidity to dump their coins. Possible reasons:. In that case, the order of the whale makes up most of the orders the price can shift far in the other direction. The selling order has a closed status now, as it was completely filled its total initial amount of However, most exchanges do provide at least some alternative for "pagination" and "scrolling" which can be overrided with extra params argument. In order to detect programmatically if the exchange in question does support market orders or not, you can use the. Also, note that all other methods above return an array a list of orders. This gives you the advantage to place your order early and increases the odds to get your order filled. Conditional order is used when you do not want your orders to show up on the Order book, which lists all active buy and sell orders. NUGGY10 https: Most often trading fees are loaded into the markets by the fetchMarkets call. What are your thoughts on misrepresented and overstated value among major exchanges? You are not guaranteed though, that the order will be executed for the price you observe prior to placing your order.

Recent Comments

The since argument is an integer UTC timestamp in milliseconds everywhere throughout the library with all unified methods. If you want to use it, you should combine the information of the order book in conjunction with technical analysis. The worst of the bunch is BCEX at over 22,x. Skip navigation. In most cases the. Some exchanges don't allow to fetch all ledger entries for all assets at once, those require the code argument to be supplied to fetchLedger method. There can be a slight change of the price for the traded market while your order is being executed, also known as price slippage. Practically, very few exchanges will tolerate or allow that. So, a closed order is not the same as a trade.

CCXT unifies date-based pagination by default, with timestamps in milliseconds throughout the entire library. More Report Need to report the video? The ledger entry type can be associated with a regular trade or a funding transaction deposit or withdrawal or an internal transfer between two accounts of the same user. However, in many cases the effects are small. Try hitting the refresh button in your browser when you have been redirected to the waiting screen minute waitso as to be able to check the status of the verification process. Instantiation To connect to an exchange and start trading you need to instantiate an exchange class from ccxt library. Some exchanges may have varying rate limits for different endpoints. All endpoints return JSON in response to client requests. What is a Sell Wall? Exchanges may temporarily restrict your access to where to buy digibyte lumen stellar API or ban you for some period of time if you are bch crypto price how high can litecoin go aggressive with your requests. The opposite is also true — a market buy can be emulated with a limit buy for a very high price. To connect to an exchange and start trading you need to instantiate an exchange class from ccxt library.

They will offer just the fetchOpenOrders endpoint, sometimes they are also generous to offer a fetchOrder endpoint as. One should pass the btg from electrum wallet to coinomi siacoin erc20 argument to ensure getting precisely the history range needed. Sign in to make your opinion count. A non-associative array a list of symbols available with an exchange, sorted in alphabetical order. Most exchanges require personal info or identification. This guide will provide you with the necessary skills to buy and sell cryptocurrencies easily. Instantiation To connect to an exchange and start trading you need to instantiate an exchange class from ccxt library. With methods returning lists of objects, exchanges may offer one or more types of pagination. You can fetch all tickers with a single call like so:. A string literal containing base URL reddit salt coin crypto storj block explorer http s proxy, '' by default. If the amount comes due to a sell order, then it is associated with a corresponding trade type ledger entry, and the referenceId will contain associated trade id if the exchange in question provides it. Most of the time users will be working with market symbols. Basically, you have to know the green walls are buy walls, the red walls are sell walls. The selling ripple price over time ripple adoption, however, is filled completely by this second match. You can get a limited count of returned orders or a desired level of aggregation aka market depth by specifying an limit argument and exchange-specific extra params like so:. The error handling with CCXT is done with the exception mechanism that is natively available with all languages.

Nathan Whitehead 13, views. All exceptions are derived from the base BaseError exception, which, in its turn, is defined in the ccxt library like so:. Most of the time you can query orders by an id or by a symbol, though not all exchanges offer a full and flexible set of endpoints for querying orders. Both methods return an address structure. To query for balance and get the amount of funds available for trading or funds locked in orders, use the fetchBalance method:. For examples of how to use the decimalToPrecision to format strings and floats, please, see the following files:. WARNING this method can be risky due to high volatility, use it at your own risk and only use it when you know really well what you're doing! If you're not familiar with that syntax, you can read more about it here. I accept I decline. Share Tweet Send Share. In order to detect programmatically if the exchange in question does support market orders or not, you can use the.

Post navigation Previous Story Previous post: Gemini moved up from 26 to salt crypto lending work for bitcoin in the BTI rankings. This is performed for all exchanges universally. The list of candles is returned sorted in ascending historical order, oldest candle first, most recent candle. It might seem that they can only go up. Versa vice if you want to sell your coins: It often means registering with exchanges and creating API keys with your account. Advanced Cryptocurrency Knowledge to ask any questions regarding cryptos! If you want more control over the execution of your logic, preloading markets by hand is recommended. The exchange-specific methods should be used as a fallback in cases when a corresponding unified method isn't available. Today however, the sale wall is almost none existent and the buy wall extremely high. This is not a bug. Those will only return just the free or just the total funds, i. Size Matters when choosing the right Wall Oven - Duration: Guide on Identifying Scam Coins. Some exchanges don't have an endpoint for fetching all orders, ccxt will emulate it where possible. The Rundown. However, the complexity of buying cryptos can be daunting for many who do not have a financial or view bitcoin wallet.dat file bitcoin new block per second is possible background.

Get the armor to fight the bear market - delivered to your inbox: An associative array containing a definition of all API endpoints exposed by a crypto exchange. You signed out in another tab or window. The goals should aim for coins that have real trader sentiment if your goal is safe growth, slow and steady is the word to the wise. Nathan Whitehead 13, views. The set of market ids is unique per exchange and cannot be used across exchanges. Binance, Coinbase, Bittrex, Bitfinex, Kraken, Poloniex, and Kucoin all have monthly visitor counts well above the rest of the top exchanges as well as very low slippage when their order books were checked. Symbols aren't the same as market ids. The params are passed as follows:. The incoming sell order has a filled amount of and has yet to fill the remaining amount of 50 from its initial amount of in total. Discount code: A few exchanges also expose a merchant API which allows you to create invoices and accept crypto and fiat payments from your clients. Essentially it works the same as the stop loss, except you set the ask price lower than the condition.

Post navigation Previous Story Previous post: It contains one filling trade against the selling order. This does not influence most of the orders but can be significant in banks afraid of bitcoin personal wallet for ripple coin cases of very large or very small orders. All exceptions are derived from the base BaseError exception, which, in its turn, is defined in the ccxt library like so:. An associative array a dict of currencies by codes usually 3 or 4 letters available with an exchange. You can follow the verification guide. WIRED 2, views. Denominations in USD is easy since it gives you the numerical market price e. Guide to Bittrex Exchange: The button at the bottom of the form is time in force. You can only have absolute control by having your own wallet. The ccxt library will set its User-Agent by default. What are your thoughts on misrepresented and overstated value among major exchanges?

Note these walls are not made by professional whales, as they are easy to spot. Python print exchange. Upon signing up you will be prompted to enter an email address and desired password before you receive a link to verify your account in your email inbox. You signed out in another tab or window. Please like, share and subscribe for more crypto news! This is odd. A successful call to a unified method for placing market or limit orders returns the following structure:. You are having to file a form and await pending decisions by the exchange, which could prove costly to those wishing to create a new account and enter into a position quickly. In terms of the ccxt library, each exchange contains one or more trading markets. Osato Avan-Nomayo May 24, More about it here: You can choose to enter a specific amount for your particular asset, in this case, we selected USD-BTC pairing with the order type set to default. Crypto Guide It currently contains the following methods:. If you already understand how to place an order, skip to the next section. The order book information is used in the trading decision making process.

YouTube Premium

The asks array is sorted by price in ascending order. Attempting to parse the symbol string is highly discouraged, one should not rely on the symbol format, it is recommended to use market properties instead. The second argument since reduces the array by timestamp, the third limit argument reduces by number count of returned items. One should pass the since argument to ensure getting precisely the history range needed. The default set is exchange-specific, some exchanges will return trades starting from the date of listing a pair on the exchange, other exchanges will return a reduced set of trades like, last 24 hours, last trades, etc. It is an associative array a dictionary, empty by default containing the params you want to override. The withdraw method returns a dictionary containing the withdrawal id, which is usually the txid of the onchain transaction itself, or an internal withdrawal request id registered within the exchange. Signing up Note: CryptoJack 44, views. For use with web browsers and from blocked locations. The user is required to stay within all limits and precision! You will get a standard userland exception if you access non-existent keys in these dicts.

A symbol is usually an uppercase string literal name for a pair of traded currencies with a slash in. It often means registering with exchanges and creating API keys with your account. The ccxt library will check each cached order and will try to match it with a corresponding fetched open order. This is an associative array of exchange capabilities e. This article is wrong on a fundamental point from the psych of the investor. More Report Need to report the video? A market order gets executed immediately. Advanced Cryptocurrency Knowledge to ask any questions regarding cryptos! You don't need to remember or use market ids, they are there for coinbase max attempts to login for bank coinbase transactions getting denied by bank HTTP request-response purposes inside exchange implementations. What to look for on Level 2 - Duration: Unlock my step what is on order in poloniex how long to transfer dogecoin from bittrex step guide that outlines how to invest in cryptocurrencies including alt coins. You can pass your optional parameters and override your query with an associative array using the params argument to your unified API. For a full list of accepted method parameters for each exchange, please consult API docs. An implicit method takes a dictionary of parameters, sends the request to the exchange and returns an exchange-specific JSON result from the API as is, unparsed. Reload to refresh your session. They usually have it available on a separate tab or page within your user account writing cryptocurrency trading program neo cryptocurrency twitter.

Trading fees are properties of markets. In order to deposit funds to an exchange you must get an address from the exchange for the currency you want to deposit there. NUGGY10 https: To pass a parameter, add it to the dictionary explicitly under a key equal to the parameter's name. It will send two HTTP requests, first for markets and then the second one for other data, sequentially. An assoc-array containing flags for exchange capabilities, including the following:. There can be a slight change of the price for the traded market while your order is being executed, also known as price slippage. A non-associative array a list of symbols available with an exchange, sorted in alphabetical order. Subscribe Here! Methods to work with account-specific fees:. In case you need to reset the nonce it is much easier to create another pair of keys for using with private APIs. Check out 3commas. The example below is from LTC this morning, a very bullish coin with huge demand. Some exchanges allow specifying a list of symbols in HTTP URL query params, however, because URL length is limited, and in extreme cases exchanges can have thousands of markets — a list of all their symbols simply would not fit in the URL, so it has to be a limited subset of their symbols.