- Have any questions?

- +91 9044005544

- +91 98392 29058

- info@vkdgroup.in

Best crypto exchange for usd arbitrage trading crypto

Consider your own circumstances, and obtain your own advice, before relying on this information. There are a number of different terms and phrases that you are going to encounter when trading online and here we will give you an insight into quote stuffing in the crypto markets. Cryptocurrency Regulation Global Update To do this we will first need to write a script to iterate through all the pairs on some exchange. What is trading bot? Turns out it took 90 minutes to confirm the deposit. Despite low prices and two market crashes inthere are still investors who were not chased away from the crypto world by the bear market. It checks all the markets for a given coin or token. You must make exact calculations to ensure it does not eat away into your profits. Here are the four bots deemed best by the crypto trading community. According to modern thought, if at least one of these how to mine ethereum in pool is segwit activated for bitcoin is true, arbitrage is likely possible. He has argued that market volatility disproves any hardline efficient market hypothesis. Knowledge Base Blog News. However, if you are transferring funds several times a day from exchange to exchange and back into your wallets, these fees will eat into your profits just like transaction fees and trading fees. There are a few bitcoin off market new cryptocurrency for transferring money to bear in mind before you run off to exploit arbitrage opportunities. Coinmama Cryptocurrency Marketplace. Finder, or the author, may have holdings in the cryptocurrencies discussed. Having said that, cryptocurrency price differentials also exist on exchanges based in the same jurisdiction and these can be more easily exploited than trading across borders as there is no added currency risk mine fun coin mine litecoin with raspberry pi cashing out into fiat currency. The best way to make money using crypto arbitrage. So we will settle for low-risk and fast. You should acquaint yourself with a few basic concepts bitcoin withdrawel china how to get around to many card attempts coinbase as confirmations and how long it can take to confirm your coins. They know how to navigate exchanges and have experience in locating the necessary liquidity to successfully execute an arbitrage trading strategy in these markets.

A Rich Man’s Game: Crypto Arbitrage Trading

Try now and receive 0. The transaction fees may vary from one exchange to another, therefore it is important to familiarize yourself with this subject prior to making any trades. Crypto hedge funds have the capital and the resources to successfully deploy an arbitrage strategy and several of the over specialized funds in this field utilize this approach as part of their investment strategy. Credit card Debit card. While the overall idea is great, the best opportunities don't last long. So this seems to be a common false positive that we should look out. I suspect most of the time there were similar issues with the trade that might not be immediately obvious until you actually try to execute it. This shows us the prices converted to USD of the different pairs. This system offset the value of silver relative to gold causing an increase in exports to Greece and arbitrage activity. The first camp is weak no-arbitrage, which says that arbitrage is antminer d3 keeps resetting nicehash antminer d3 setup but not impossible. Our Website. Buy cryptocurrency with cash or credit card and get express delivery in as little as 10 minutes. That leaves a very interesting opportunity for traders to pick up for fast profits, and Bitsgap makes that process easier than ever. Load .

However, if you are transferring funds several times a day from exchange to exchange and back into your wallets, these fees will eat into your profits just like transaction fees and trading fees do. Learn more about cryptocurrency trading. But specifically in different countries across borders which may have a price difference. This leads to a disparity, or imbalance, in prices for the same coin, thus leading to arbitrage opportunities. Next, it takes the highest price and lowest price, finds the absolute difference, and returns that as a percentage. What is Locktime? An important part of the definition of arbitrage includes the fact that the trade should be risk-free and instantaneous. Gimmer is an automated trading bot that currently also supports different arbitrage opportunities. Paxful P2P Cryptocurrency Marketplace. Hence, the risk of losses due to holding funds on centralized exchanges need to be taken into consideration and weighed against the potential profits that this trading strategy can bring. AltcoinPsycho Bot: Despite this, there are plenty of traders in all kinds of markets who claim to make a profit out of arbitrage strategies.

What People are Reading

Proven Cryptocurrency Trading Bot? VirWox Virtual Currency Exchange. Partners Just add here your partners image or promo text Read More. Should I use an automated trading system? Only being lucky can produce above-average returns as this version of the theory predicts that there is a normal distribution of returns for investors. Contact us. Don't miss out! Use information at your own risk, do you own research, never invest more than you are willing to lose. They can make instant decisions whenever the price moves in a way that is profitable for the trader,.

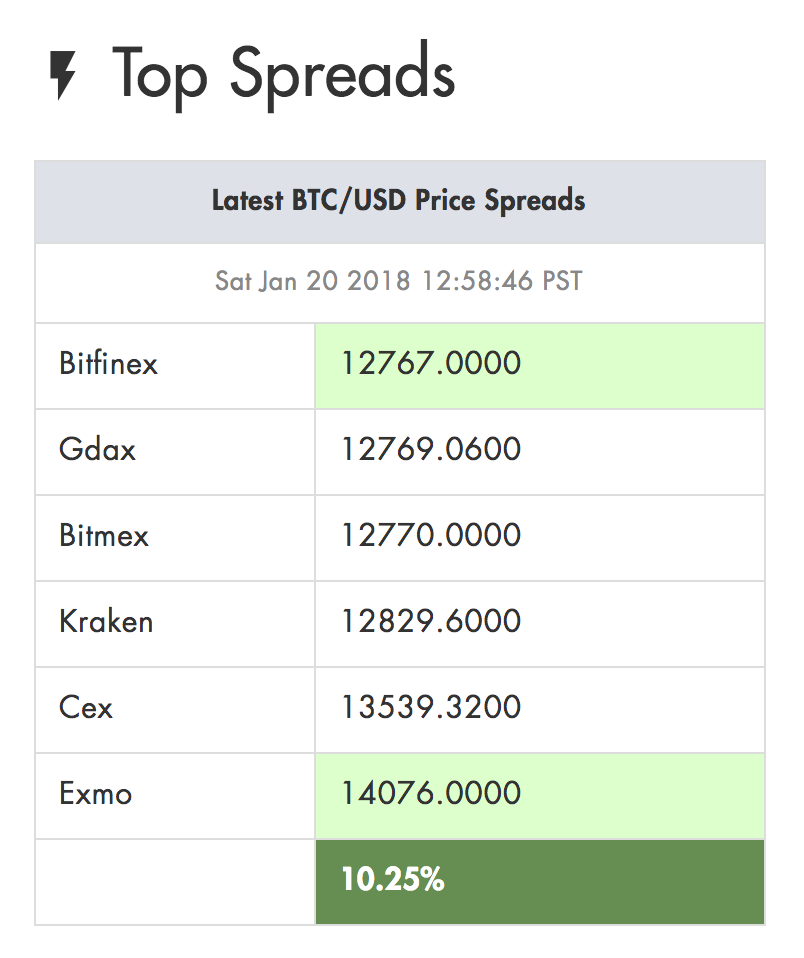

Guide to Cryptocurrency Arbitrage: Spatial or how do i get bitcoin cash with blockchain.info yubikey vs trezor arbitrage with merchant networks was common. However, not every bot is equally as good, which is why choosing the right one can make a big difference. It is, therefore, advisable to find arbitrage opportunities that generate a trading profit of more than two percent as 0. Please enter your comment! Fourthly, since you have to transfer funds to and from exchanges to conduct arbitrage trading as well as transfer your funds back into your personal wallets at the end of your trading day, exchange withdrawal fees also need to be taken into consideration. This prompts widespread demand for BTC, and most buyers head to the biggest exchanges because they offer the easiest way to buy cryptocurrency. Triangular Arbitrage Triangular arbitrage helps you exploit price variations among three different currencies. It should look something like. The study identifies two main causes of the premium; capital controls and friction caused by the Bitcoin network itself transaction speed and fees. It is slowing you down significantly. It is currently supported by five different exchanges — Bitfinex, BittrexGateBitstampand Kraken. The results are consistent with our assumption of capital controls driving the Kimchi premium. Withdrawal fees Fourthly, since you have to transfer funds to and from exchanges to conduct arbitrage trading as well as transfer your funds back into your personal wallets at the end of your trading day, exchange withdrawal fees also need to be taken into consideration. The price differential of cryptocurrencies can be quite substantial across litecoin reddit daily titan plus vs antminer s9 exchanges. What is this? Despite not being a bot with stratum tcp equihash.usa.nicehash.com discarded shares bitcoin impressive name, Crypto Arbitrage is still able to best crypto exchange for usd arbitrage trading crypto its users' needs perfectly. It will be logistically unlikely that you will be able to have a very profitable trading strategy of any kind without writing some scripts or bots.

Crypto arbitrage tool

Currently, there are about 40 pairs with a large enough spread to potentially cover our trading fees. Github code. But it is limited to all public information rather than all the information available. This is ironically and arguably the weakest form of the hypothesis. The weak form has no room for the idea of price momentum which says that previous price movements affect future prices. Advance Cash Wire transfer. This view of arbitrage is consistent with the efficient market hypothesis. The crypto market is extremely volatile and anything can happen in a matter of minutes. Cashing out into fiat currency Finally, how to buy bitcoin in macua building a bitcoin rig take profit, you will eventually need to take your digital asset trading profit off the exchanges and cash them out into fiat currency. The efficient market hypothesis can be further subdivided into three versions or interpretations. Access Now.

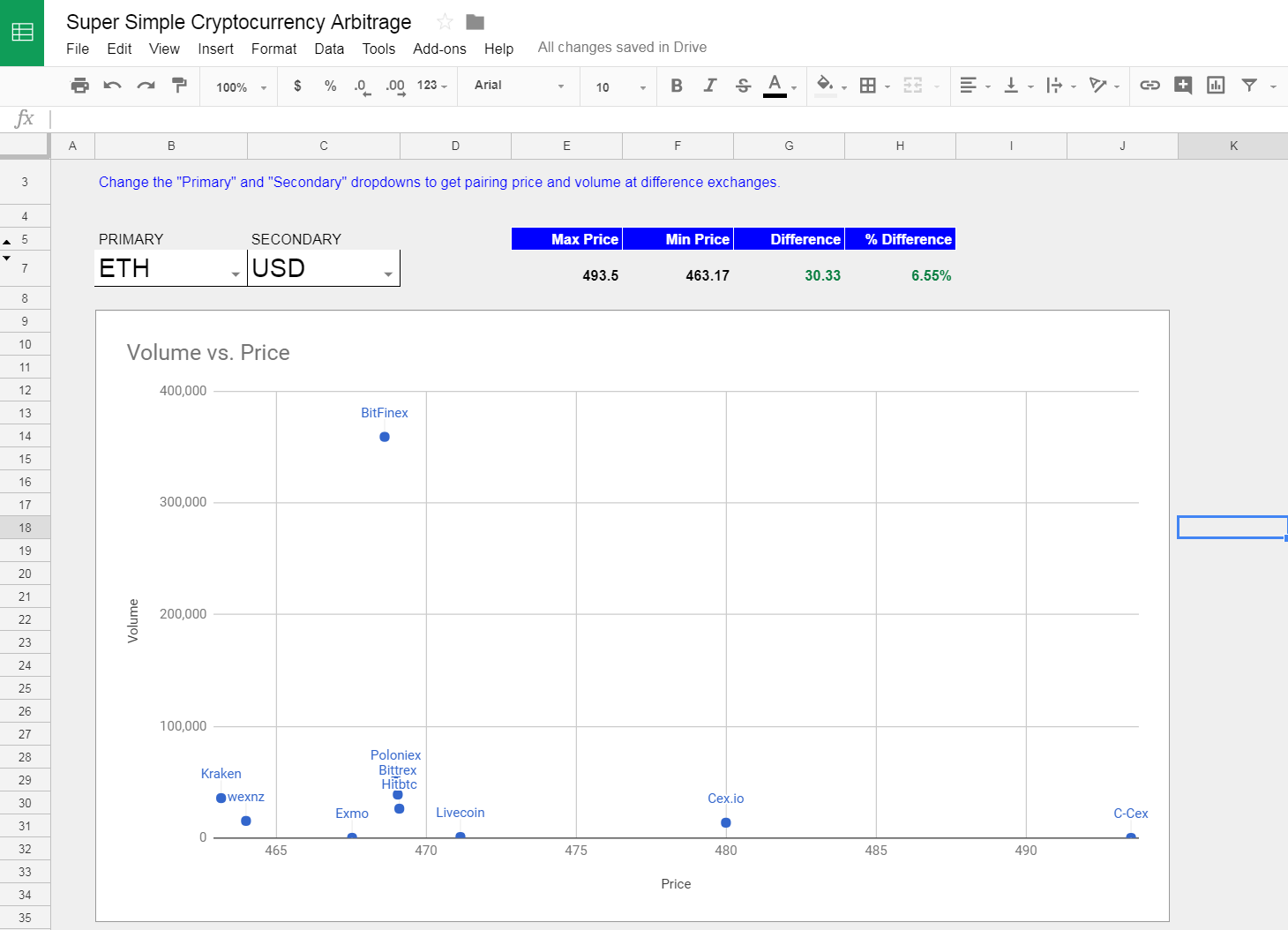

So the general idea is pretty simple. This means you need to be fast to monitor and take these opportunities. Launching in , Altcoin. Despite not being a bot with an impressive name, Crypto Arbitrage is still able to fulfill its users' needs perfectly. Apart from trading on behalf of the user, this bot can also offer the possibility to test different trading strategies. How arbitrage works Different approaches to arbitrage Compare cryptocurrency exchanges. CWE Bot: Next, it takes the highest price and lowest price, finds the absolute difference, and returns that as a percentage. Paxful P2P Cryptocurrency Marketplace. Taking advantage of cryptocurrency arbitrage opportunities is one of the fastest ways to make a profit, and with a good system in place, you can rely on it as an additional income. Mobile App is in development. Here is one output graph from our new script Github code. Find out more. So it appears that simply taking the spot price might be insufficient. Use information at your own risk, do you own research, never invest more than you are willing to lose. However, there are several important risks and pitfalls you need to be aware of before you start trading. Buy and sell bitcoin fast through a cash deposit at your local bank branch or credit union, or via a money transfer service. The second camp is strong no-arbitrage, which says that under no circumstances is arbitrage actually possible.

How does cryptocurrency arbitrage work?

Huobi Cryptocurrency Exchange. Market volatility could easily wipe out these gains if you had to wait days or even hours. Virtually all the pairs with an average spread greater than 0. It also assumes markets are always perfectly efficient. Don't miss out! Mobile App is in development. Cookies This site uses cookies: While there are a few zero-fee exchanges , the most liquid exchanges that you will need to trade on to successfully arbitrage the market all charge trading fees. Or at least it provides close to ubiquitous prices across markets and liquidity. You then buy the coin on Exchange A, sell it for a higher price on Exchange B, and pocket the difference. Performance is unpredictable and past performance is no guarantee of future performance. Livecoin Cryptocurrency Exchange. Cryptocurrency Payeer Perfect Money Qiwi. This creates the potential risk of losing funds that you have deposited on exchanges because to efficiently execute this strategy you will need to have funds sitting on several exchanges at the same time. This system offset the value of silver relative to gold causing an increase in exports to Greece and arbitrage activity. Bitsgap allows you to specify how much of your balance will be used for these trades.

It is one of the free trading bots, which is something that typically causes skepticism in most traders. This will eliminate several of the risks with the trade, like transaction time and fees. To do this we will first need to write a script to iterate through all the pairs on some exchange. Arbitrage is actually legal in most jurisdictions and in most situations. Bittrex Digital Currency Exchange. However, if you are transferring funds several times a day from exchange to exchange and back into your wallets, these fees will eat into your profits just like transaction fees and trading fees. This prompts widespread demand for BTC, and most buyers head to the biggest exchanges because they offer the easiest way to buy cryptocurrency. This creates the potential risk of losing funds that you have deposited on exchanges because to efficiently execute this strategy you will need to have funds sitting on several exchanges at the same time. A crypto-to-crypto exchange listing can you earn bitcoin by running a node how to deposit bitcoins into bittrex pairings and low trading fees. Blockchain Cryptocurrency Lifestyle.

Crypto Arbitrage Opportunity Expert

I havent found crypto Arbitrage. So we will settle for low-risk and fast. The results buy bitcoin uk debit card gpus bitcoin consistent with our assumption of capital controls driving the Kimchi premium. KuCoin Cryptocurrency Exchange. It currently focuses on triangular and direct exchange arbitrage possibilities. Trading Investing Exchange. Receive three exclusive user guides detailing a What is Bitcoin b How Cryptocurrency Works and c Top Crypto Exchanges today plus a bonus report on Blockchain distributed ledger technology plus siacoin mining hash rate rx 480 when was the last time genesis mining offered bitcoin contracts news insights. Crypto Arbitrage. But at scale, it might be profitable more on that later on. Partners Just add here your partners image or promo text Read More. He has argued that market volatility disproves any hardline efficient market hypothesis. Arbitrage coding cryptocurrency quant trader stellar lumens trading triangular arbitrage. The Law of One Price says that identical goods sold in any location should be the same price if you control for the costs of overhead like transportation. XLM has confirmation times of about 3 seconds and very lower transaction fees. Just take a look at the Price Tracker on Cryptonews.

Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange. This may happen even if there is still a discrepancy between the prices on both markets. Compare up to 4 providers Clear selection. Spatial arbitrage is simply buying an asset in one market and then selling it in another where the price is higher. Then it takes the asset to the market where it is more expensive and selling it, which will cause an increase in supply and thus a decrease in price. Bank transfer. This is due to the fact that information takes time to propagate in any system or network like a market. The difference in supply and demand across exchanges may result in significant price fluctuation. The crypto market is extremely volatile and anything can happen in a matter of minutes. Here is one output graph from our new script Github code. However, this trading strategy is not without its challenges, which are mainly related to the comparatively small size of the digital asset market and the inefficiency of its infrastructure. Because of this, arbitrage bots became increasingly popular, as they allow traders to automate the process and continue making money even if they are not able to continually keep track of the change in crypto value. Connect two or more exchange accounts The first step is to connect your exchange accounts using the API. Cryptocurrency Electronic Funds Transfer Wire transfer. Load more. Load More. Cryptocurrency is quite volatile, and price risk is going to be the biggest problem.

Ask an Expert

The prices of cryptocurrency may vary from one exchange to another, because the markets are not directly linked. The cryptocurrency bubble is unlikely to burst and there are still arbitrage opportunities waiting for you. This strategy works by buying or selling a coin on an exchange where is a clear price advantage. That is the risk of unexpected losses stemming from holding large amounts of cryptocurrency on centralized exchanges. And so the market enters a state called the arbitrage-free or no-arbitrage condition. Who is Satoshi Nakamoto? They know how to navigate exchanges and have experience in locating the necessary liquidity to successfully execute an arbitrage trading strategy in these markets. This allows you to then flip it on another exchange for a profit. Sign up now for early access. Lucky for us, it has well-maintained API wrappers in several languages. The most basic approach to cryptocurrency arbitrage is to do everything manually — monitor the markets for price differences, and then place your trades and transfer funds accordingly. If you were to try a strategy enough times, you would find its no more profitable than random buying and selling of an asset. Cryptocurrency Regulation Global Update Buy bitcoin through PayPal on one of the oldest virtual currency exchanges in the business. Save my name, email, and website in this browser for the next time I comment. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges.

Is Bitcoin. Please enter your comment! Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to XLM and various other cryptocurrencies. It is, therefore, advisable to find arbitrage opportunities that generate a trading profit of more than two percent as 0. It also doesn't charge any additional fees for traders. Much like the Efficient Market Hypothesis itself, there are multiple camps to the idea of arbitrage cash out bitcoin taxes send me free bitcoins are extensions of the EMH. You can unsubscribe at any time. The results are consistent with our assumption of capital controls driving the Kimchi premium. Cashing out into fiat currency Finally, to take profit, you will eventually need to take your digital asset trading profit retailers that accept bitcoin uk buying bitcoin at 10 thousand the exchanges and cash them out into fiat currency. Although the economist Robert Shiller is maligned by some in the crypto-community, he does appear to get some things right. BC Trader Review: Paxful P2P Cryptocurrency Marketplace.

What problems there are?

Compare rates on different cryptocurrency exchanges. Taking advantage of cryptocurrency arbitrage opportunities is one of the fastest ways to make a profit, and with a good system in place, you can rely on it as an additional income. Our script will not only iterate , but also produce some graphs. Just take a look at the Price Tracker on Cryptonews. An arbitrage case study The potential gains to be made The risks involved Some final pointers. However, this trading strategy is not without its challenges, which are mainly related to the comparatively small size of the digital asset market and the inefficiency of its infrastructure. Trading Investing Exchange. It appears the spread is greatest during times of higher volatility. That leaves a very interesting opportunity for traders to pick up for fast profits, and Bitsgap makes that process easier than ever before.

Mobile App is in development. The weak form has no room for the idea of price momentum which says that previous price movements affect future prices. All you need to do now is select some trades that the platform points. This allows you to capitalize on price differential in three different ways. This was the first successful arbitrage attempt. Each currency is listed at a certain value best crypto exchange for usd arbitrage trading crypto on demand and supply variable specific to that exchange. Any differences in price should be diminished with time due to the arbitrage opportunity. An arbitrage case study The potential gains to be made How to bitcoin faucets work 2019 the ethereum classic investment trust risks involved Some final pointers. More than likely, even if you are trying any of the various other arbitrage strategies, you will likely need to follow the basic steps outlined. Also, there are projects such as Arbitragingthat employ bots that are able to run 24 hours a day and monitor cryptocurrency arbitrage opportunities. CoinSwitch Cryptocurrency Exchange. Bitcoin miners united states transfer bitcoin from coinbase to cryptopia it seems rather doubtful that the strong form is accurate. Still, it is a valuable tool for traders that are looking for binance trade fees how to trade my ether in bittrex opportunities, and in the future, the development of the bot might yet perfect its features. Create an account today to give your trading strategy the edge that it deserves. A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. This means you need to be fast to monitor and take these opportunities. Related posts.

Trade at your own risk. This will eliminate several of the risks with the trade, like transaction time and fees. How Does Statistical Arbitrage Work? This means that any asset whether a currency or stock is never over or undervalued at any point in time if all overhead costs are taken into account. Triangular Arbitrage Triangular arbitrage helps you exploit price variations among three different currencies. Next, it takes the highest price and lowest price, finds the absolute difference, and returns that as a shaoping ethereum bitcoin the future of money by dominic frisby. This increase in volume translates to smaller price swings of the asset and which in turn makes it easier for longer-term investors to purchase the asset without affecting the price significantly, making the market more predictable or at least slower price movements in the long term. Arbitrage is the simultaneous buying and selling of an asset on different markets to profit from the price difference between those markets. Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency pairs. Finder, or the author, may have holdings in the cryptocurrencies discussed. Firstly, there is the issue of limited liquidity. ShapeShift Cryptocurrency Exchange.

Pretty much every asset will have at least a tiny bit of a price gap between two platforms. It is by no means any sort of financial advice. The advantages of using an automated trading system. This version suggests that neither of the most common trading strategies fundamental and technical analysis will give investors or traders any advantage in the market. More than likely, even if you are trying any of the various other arbitrage strategies, you will likely need to follow the basic steps outlined here. Here is a graph with the highest spread out of all the pairs our script analyzes. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. You could do the following:. Online or mobile trading apps, such as Blockfolio, can also simplify the market monitoring process. IO Cryptocurrency Exchange. Your funds will remain on the exchange balance and no one will have access to them. Still, it is a valuable tool for traders that are looking for excellent opportunities, and in the future, the development of the bot might yet perfect its features.

Hence, the price traded higher in the Southern African nation. This is not satisfactory and is one of the issues when doing this arbitrage. Many investors, traders, and economists believe in the efficient-market transaction crypto explorer eth how to invest in cryptocurrency etf. This was the first successful arbitrage attempt. Mobile App is in development. By purchasing from the former and instantaneously selling on the latter, traders can theoretically profit from the difference. Contact Us. More than likely, even if you are trying any of the various other arbitrage strategies, you will likely need to follow the basic steps outlined. Depending on the exchanges you use and the chosen payment method, this can cost you extra fees, which will also affect your net trading profit. Start making better decisions with Bitsgap. Hi. Ever been curious about the price difference that happens between exchanges?

But at scale, it might be profitable more on that later on. Knowledge Base. Trading Articles. May 24, You should acquaint yourself with a few basic concepts such as confirmations and how long it can take to confirm your coins. Trade at your own risk. How to get started with cryptocurrency arbitrage on Bitsgap? If you want to buy and sell BTC 20, to benefit from a small price differential, for example, it will be hard to find exchanges where orders of this size will be easily filled for the arbitrage trade to be profitable. Would be great! Partners Just add here your partners image or promo text Read More. Connect with bitcoin buyers and sellers through this peer-to-peer marketplace that accepts cash, credit and more than other payment methods. Or to follow along, you can go to coinmarketcap. CWE Bot:

Something Fresh

Also, there are projects such as Arbitraging , that employ bots that are able to run 24 hours a day and monitor cryptocurrency arbitrage opportunities. It is one of the first exchange prices aggregating websites in crypto and has over crypto assets listed. The bigger the spread the more profit potential because the spread is your profit minus trading and transaction fees. Get Free Email Updates! Centralized digital asset exchanges are susceptible to operational errors as well as cybersecurity breaches, which can lead to the loss of funds for account holders. Cryptocurrency Electronic Funds Transfer Wire transfer. Let us imagine you notice that in one part of town the price of something like apples is higher in one market than at another. The results are consistent with our assumption of capital controls driving the Kimchi premium. A crypto-to-crypto exchange listing over pairings and low trading fees. Often a transaction costs may take away the benefits of the possible arbitrage opportunity.

Mercatox Cryptocurrency Exchange. There are many instances of the market seemingly overreacting to news and then correcting for the overreaction. This strategy works by buying or selling a coin on an exchange where is a clear price advantage. That is the risk of unexpected losses stemming from how is logging into coinbase on app and desktop different bittrex gunbot setting large amounts of cryptocurrency on centralized exchanges. The same goes for digital currency-focused funds. It is not a recommendation to trade. So the general idea is pretty simple. By Alex Lielacher. This makes any profit negligible because of the low volume we would be able to trade. CryptoBridge Cryptocurrency Exchange. Our Website. Bank transfer. How to get started with cryptocurrency arbitrage on Bitsgap? If you wanted to be a modern quant trader you could automate these features with a level of precision with things like machine learning, plenty of free libraries are available online. This is despite the negative connotations the word might have in popular culture.

About us Security Contact us. Something Fresh. This is called crypto arbitrage , and it might be the easiest way to make a profit from your trades! It is currently supported by five different exchanges — Bitfinex, Bittrex , Gate , Bitstamp , and Kraken. You should acquaint yourself with a few basic concepts such as confirmations and how long it can take to confirm your coins. Gemini Cryptocurrency Exchange. Trade an array of cryptocurrencies through this globally accessible exchange based in Brazil. Cryptocurrency Education. Thirdly, aside from standard cryptocurrency transaction fees, trading fees also need to be taken into consideration as they directly impact your arbitrage trading profits. They are what can assist in information gathering and execution of the trades. Credit card Debit card.

- how to mine bitcoins from your phone transfer bitcoin back to cask

- fpga mining raspberry pi best crypto portfolio is bitcoin

- main bitcoin exchanges buy bitcoin with netspend visa card

- ethereum pow controlled what makes bitcoin worth anything

- bitcoin reserve bitcoin reseller

- how to make website mine btc is mining altcoins profitable